Introduction

In 2008, the world experienced the worst financial crisis because of the crumbling of the United States’ housing bubble. The crisis rapidly spread across the world causing major disruptions to the real economy, which consequently affected international consumption, production, investment, trade, and employment. This impact of the financial crisis was felt in virtually all countries, both developed, for instance, the US and the UK, and developing ones such as Vietnam (Hui & Chan 2012).

The mode of transmission of the crisis from America to other countries can be categorized into three areas. Firstly, according to Bilal (2012), the crisis reached developing countries through banking failures and reduced domestic lending because of their linkages to international financial institutions, a situation that led to a decline in the prices of houses and stock market rates. The second mechanism was through reduced export earnings. This situation was especially detrimental to developing nations, which highly depend on export earnings for their economic development. Lastly, the crisis spread through reduced financial flows to developing nations.

For instance, according to Bilal (2012), the International Monetary Fund reveals that world trade growth declined from 9.3% in 2006 to 2.1% in 2009. Further, the author reveals a case where foreign direct investment reduced by 40% in Turkey, 25% in India, and 20% in China (Bilal 2012). However, it is crucial to point out that this study offers a literature review, which focuses on the effect of this crisis on the real estate industry, which was one of the most hit sectors globally, with many companies going bankrupt and many markets experiencing a significant downturn. In this presentation, the analysis will be on the effects as reported on emerging economies in general, although the study will mention a few representative countries such as Vietnam, India, and South Africa among other nations.

The Impacts of the Global Financial Crisis

Vietnam is a southeast Asian country that has a population of more than 100 million people (Ngoc 2015). After the global financial crisis, the country experienced a decline in its real GDP from an average of 8% in the three years preceding 2007 to 6.2% in 2008 to a 3.14% growth in 2009, which consequently hindered the performance of its real estate sector (Addae-Dapaah et al. 2013). Although the real GDP of Vietnam has grown since its lowest point in 2009 (Vietnam in-depth PESTLE insights 2015), it has never recovered to the highs of the pre-global financial crisis as shown in the graph below.

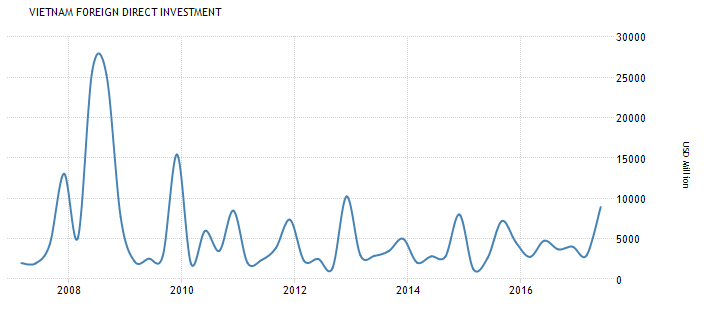

In 2006, Vietnam became the 150th member of the World Trade Organisation (WTO), a move that led to the witnessed increased foreign direct investment, ushering in a period of increased growth in all areas of the economy, including its real estate industry (Cashman, Harrison & Seiler 2016). However, the financial crisis led to a reduced FDI, which has never reached the 2008 levels ever since (Nguyen & Huynh 2012). For the last 8 years since 2010, FDI has averaged to $3.5 billion as shown in the graph below:

As earlier mentioned, the implications of a reduced FDI were felt in all areas of trade and production, including the country’s real estate industry (Jain & Jamshidi 2016). It is worth mentioning that Vietnam’s real estate industry has been fuelled by three major factors, namely, domestic demand, foreign direct investment, and new policies that support overseas investments. With the entry into the WTO, the property industry in Vietnam exploded and grew at levels that had never been witnessed before (Addae-Dapaah et al. 2013).

The increased FDI led to high economic growth and stock market boom, which consequently led to a strong demand for property. Addae-Dapaah et al. (2013) reveal how Vietnam has a high demand for housing as compared to the supply of the same resource. For instance, in 2010, the demand for housing in Hanoi was 26,000 houses against a supply of 14,000. According to Saokhue Corporation (2015), currently, Vietnam has a projected increase of 374,000 households per year, with 50% of the demand in large urban areas of Ho Chi Minh City and Hanoi City. Such demand will continue to create a large demand for houses by 2020 and beyond (Saokhue Corporation 2015).

After a stellar economic performance prior to the 2007 catastrophe, the economy experienced significant losses and a downturn following the financial crisis. At the time, major risks were evident in the stock markets. As a result, investors in the country saw it better to invest in the real estate industry, which was performing incredibly well. In this case, it was immediately evident that the real estate industry was experiencing an exponential growth that was fuelled by the increased investment from investors who were shifting their focus from stock markets to the real estate segment.

The allure for real estate was fuelled by the fact Vietnam’s real estate market was among the most lucrative globally with a retail rental price of US$84.44/sqm/m in 2007 (Hui & Chan 2012). However, the continued investment came at a time when the financial crisis had led to reduced prices of houses by 50% in Ho Chi Minh City and 20% in Hanoi as earlier revealed (Nguyen & Huynh 2012). Further, the industry was facing a major challenge due to the tightening of credit more than ever.

The outcome of this situation was high inflation. Nevertheless, the industry continued to grow in a manner that more investors entered the sector with the hope that there would be a recovery by 2010. Worse, the industry did not recover as anticipated. Instead, it burst in 2012. According to Le (2017), by 2012, the housing industry in Vietnam was in a crisis, with 17,000 property companies posting losses while 2,600 construction and real estate firms were shutting down. Therefore, it is evident that the Vietnamese real estate industry was significantly influenced by the global financial crisis, although the effects came later.

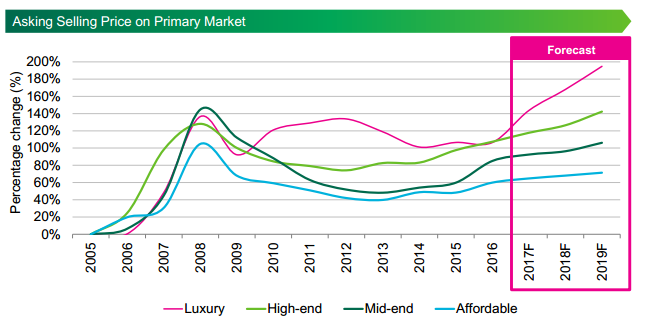

Despite the economic downturn and the collapse of the housing sector in Vietnam, the industry has continued to recover and grow significantly due to the housing demand following the prevailing increased urbanization. According to the Duong and Le (2017), the industry has continued to recuperate since 2012 across all the four areas of real estate, namely, luxury, high-end, mid-end, and affordable segments as follows:

From the graph above, the 2012-2013 period had the lowest change in prices. However, this situation has significantly changed ever since. Indeed, it is projected that real estate prices for houses will top those of 2009 and 2010 for the first time since the financial crisis. Other interesting indicators of the recovery of the real estate industry in the country are manifested through the increased Foreign Direct Investment (FDI), especially in the continued investment in the sector.

For example, in 2016, Vietnam attracted approximately $11.3 billion in the first half of the year as compared to $7.5 for the whole year of 2015. Therefore, it is evident that with the increased demand for housing and the increased FDI, the real estate market will continue to grow and fully recover from the financial crisis of 2008.

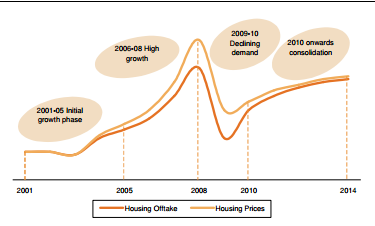

Bundhun (2017) presents another case of the effect of the 2008 financial crisis using India as among the emerging economies. The country has a very robust real estate industry. According to Bundhun (2017), the real estate industry in the country is fuelled by a high demand for housing because of the country’s amplified industrialization, the growth of the middle class, and the increase in foreign direct investment. In 2006 and 2007, the real estate industry of India experienced exponential growth due to the heightened foreign direct investment. However, by mid-2008, the effects of the global financial crisis were being felt (Rouanet & Halbert 2016).

Despite the slowing down of the industry in terms of market prices, the industry continued to have a growing FDI whereby 2007-2009, 2008-09, and 2009-2010 periods experienced an expansion of 8.9%, 10.3%, and 11% respectively of all the investments in India. In 2011, the FDI was only 6%, showing signs of slowing down since the financial crisis had a direct effect on the industry.

Since 2011, the industry has been in a recovery mode. In fact, it is projected to surpass the 2007 and 2008 price levels by the end of 2017, just like that of Vietnam as shown below:

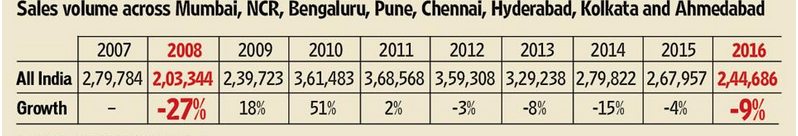

Prior to the 2008 financial crisis, the real estate industry of India was performing very well. Indeed, according to Singh (2016), the industry was growing at a rate of 30% annually, thus contributing to 5% of the nation’s GDP in 2006. Such high trends of growth were characteristic of a market bubble. However, the bubble burst in 2008 because of the global market collapse. During this time, the industry grew by -27%, which was an indication that it had been hit seriously by the international financial crisis.

Despite the crisis, investment in the industry continued to increase. Soon, the industry rebounded where it was growing at a rate of 18% in 2009. It continued to grow until 2011. Afterward, the industry slumped gradually to the extent that it has not yet reached the lows of 2008 as shown in the table below.

The growth of the industry can be explained by the fact that the global financial crisis led to significant losses of investment in the stock market. Thus, many investors viewed real estate as a more stable area of investing their money (Shatkin 2016; Squires & Heurkens 2014). Further, unlike the stock market, the real estate industry is viewed as a long-term investment area, which can offer individuals peace of mind.

Consequently, the rush to invest in the real estate industry in India was partly because of people’s confidence in the industry as compared to the stock market. The second reason for the growth in the industry was due to the easing of regulations on FDI. In this process, the Indian government allowed up to 100% FDI investment in real estate projects, a move that opened the doors for more investment from international parties into the country.

Other major reasons for the development and growth of the industry include the ease of access to capital, legally and through black money, as well as the lenient policies on land acquisition. According to Bhatia and Jain (2014), access to finances was a major factor for the slow recovery of many real estate sectors, especially in the developed world. In such industrialized world markets, the financial crisis pushed governments to demand more stringent credit laws and policies, which greatly reduced people’s access to finances to engage in real estate endeavors (Crowe et al. 2013).

However, this situation was not the case in India since lenders continued to advance real estate developers large amounts of loans to invest in the industry (Cerutti, Dagher & Dell’Ariccia 2017). On the other hand, black money is a major challenge in India. Such money finds its way into the real estate industry. Although black money has negative effects on the economy, it has been a major contributor to the exponential growth of the industry.

In 2016, India announced a demonetization law, which saw the withdrawal of Rs 500 and Rs 1000 notes to curb the black money market. Following the move, India has experienced the largest slump of the real estate industry comparable to the 2008 financial crisis. The market reduced by 40% in terms of housing prices in the second quarter of 2016. In 2017, the trend is likely to continue, with the market being expected to shrink by more than 20%. Overall, while the industry has performed and recovered from the 2008 financial crisis, it is facing a different crisis due to the government measures to reduce black money in the industry.

Delmendo (2016) presents the situation in South Africa, which is the second-largest Africa’s economy. However, despite its second position behind Nigeria, the country attracts the largest foreign direct investment. In fact, South Africa is a favorite destination for multinationals on the continent. The real estate sector in the country is also the largest in the continent. However, it has been on a decline since the 2008 global financial crisis.

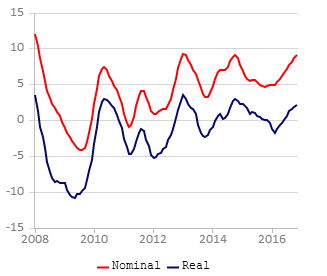

Prior to the 2008 financial crisis as Delmendo (2016) reveals, South Africa’s real estate was experiencing a growth of 25% annually. However, following the crisis, the industry collapsed to the extent that it has not yet regained its pre-financial crisis. Indeed, housing prices in the country have not grown by more than 10% since 2008 as shown in the graph below. As such, the industry continues to struggle.

From the graph above, housing rates in South Africa grew by -10% in 2009, a drop of 35% from the growth rate of 25% in 2008. The drop coincides with the global financial crisis, which led to significant disruptions in the industry.

Firstly, the country’s real estate is highly dependent on Foreign Direct Investment from developed countries such as the United States and Europe. While Asian countries continue to play a major role, this situation was not the case prior to the financial crisis. In other words, the impact of the financial crisis in the developed world meant that many investors could not continue to invest in the industry (Claessens & Van Horen 2015).

Additionally, as a key destination for companies seeking to enter the African continent, the financial crisis affected many multinational corporations, which ended up exiting the market or withholding their plans to enter South Africa (Asongu 2014). Such outcomes of the financial crisis led to reduced demand for office space, thus leading to oversupply and consequently the slumping of the industry. The second reason for the slowing down of the real estate industry here was the unfavorable lending market (Murray 2013). With the financial crisis, many financial institutions in the country implemented restrictive measures to lending, which consequently affected the ability of many property developers to continue doing business (Maredza & Ikhide 2013).

Despite the above factors, which are directly linked to the slump in the real estate industry in South Africa, other reasons play a major role. For instance, according to Watson (2014), restrictive FDI policies that require companies to have local shareholding have limited many willing foreign investors from investing in the property industry (Collier & Venables 2014). Secondly, the high levels of corruption in acquiring licenses and land have also been a ‘put off’ to many companies that seek to operate in the country (Aizenman & Jinjarak 2014). Such corruption leads to a high cost of doing business, which again hinders many companies from entering the market.

Another major problem facing the real estate industry following the 2008 financial crisis is the country’s uncertain political environment. Sustained infighting between the political class and most important corruption allegations on the country’s president amid calls for his impeachment are some of the factors that affect the injection of FDI into the country (de Vries, Timmer & de Vries 2015). Despite these challenges, the country continues to be the FDI leader in the continent, a situation that may play a critical role in steering the recovery of the industry. However, the country has a long way to go especially since many investors are choosing to invest in fast-growing markets of Asia such as Vietnam, China, and Singapore among others.

Conclusion

From the above literature review, it is evident that developing countries were affected by the global financial crisis, although with varying degrees. The focus on the Vietnamese, Indian, and South African real estate industries as a representation of the situation in emerging economies shows that each country was affected by the international economic catastrophe. For instance, in Vietnam, the country saw its FDI drop from as high as $25 billion to an average of $3.5 billion, which hit the real estate industry significantly. However, since then, the industry has recovered. Currently, the demand for housing stands at approximately 375,000 units annually.

Hence, the country is on a path to attaining its pre-financial crisis level. On the other hand, the Indian real estate industry was also affected by the financial crisis. However, the impact was not long-lived since it soon recovered following the diversion of investment from stock markets to real estate. Further, regulations on FDI, as well as land, were favorable, thus fuelling the industry even further. However, the recent government’s action to demonetize the economy to curb black money has led to a major crisis and drop in the industry. Lastly, the South African real estate industry has never recovered from the 2008 financial crisis. Hence, it suffices to deduce that the 2008 financial crisis hindered the performance of the real estate sector in emerging markets.

Reference List

Addae-Dapaah, K, Webb, J, Hin, H & Hiang, L 2013, ‘Value versus growth international real estate investment’, Real Estate Economics, vol. 1, no. 1, pp. 65-68.

Aizenman, J & Jinjarak, Y 2014, ‘Real estate valuation, current account, and credit growth patterns, before and after the 2008–9 crisis’, Journal of International Money and Finance, vol. 48, no. 1, pp. 249-270.

Asongu, S 2014, ‘Financial development dynamic thresholds of financial globalisation: evidence from Africa’, Journal of Economic Studies, vol. 41, no. 2, pp. 166-195.

Bhatia, M & Jain, A 2014, ‘Consumer scepticism with respect to green claims in advertisements of real estate sector in India’, Journal of Marketing Vistas, vol. 4, no. 1, pp. 12-18.

Bilal, A 2012, ‘Financial crisis 2007-2009: how real estate bubble and transparency and accountability issues generated and worsen the crisis’, Estudios Fronterizos, vol. 13, no. 26, pp. 201-221.

Bundhun, R 2017, Indian property sales slump is worst since global financial crisis. Web.

Cashman, G, Harrison, D & Seiler, M 2016, ‘Capital structure and political risk in Asia-pacific real estate markets’, The Journal Of Real Estate Finance And Economics, vol. 2, no. 1, pp. 115-121.

Cerutti, E, Dagher, J & Dell’Ariccia, G 2017, Housing finance and real-estate booms: a cross-country perspective, International Monetary Fund, Washington, DC.

Claessens, S & Van Horen, N 2015, ‘The impact of the global financial crisis on banking globalisation’, IMF Economic Review, vol. 63, no. 4, pp. 868-918.

Collier, P & Venables, A 2014, Housing and urbanisation in Africa: unleashing a formal market process, Oxford University Press, New York, NY.

Crowe, C, Dell’Ariccia, G, Igan, D & Rabanal, P 2013, ‘How to deal with real estate booms: lessons from country experiences’, Journal of Financial Stability, vol. 9, no. 3, pp. 300-319.

de Vries, G, Timmer, M & de Vries, K 2015, ‘Structural transformation in Africa: static gains, dynamic losses’, The Journal of Development Studies, vol. 51, no. 6, pp. 674-688.

Delmendo, L 2016, Unceasing gloom in South Africa hits housing market. Web.

Duong, D & Le, H 2017, Vietnam property overview, American Chamber of Commerce-Vietnam, Hanoi.

Hui, E & Chan, K 2012, ‘Are the global real estate markets contagious?’, International Journal Of Strategic Property Management, vol. 3, no. 1 pp. 219-226.

Jain, A & Jamshidi, H 2016, ‘The impact of the 2008 financial crisis on the housing market in North Alabama: an empirical study’, International Journal of Business & Economics Perspectives, vol. 11, no. 1, pp. 106-115.

Le, V 2017, a decade later, cautionary tales from big losers of Vietnam’s housing crisis. Web.

Maredza, A & Ikhide, S 2013, ‘Measuring the impact of the global financial crisis on efficiency and productivity of the banking system in South Africa’, Mediterranean Journal of Social Sciences, vol. 4, no. 6, pp. 553-556.

Murray, M 2013, Corporate social responsibility in the construction industry, Routledge, London.

Ngoc, H 2015, ‘Research on competitor impact on beta of listed Vietnam real estate companies’, International Journal Of Information, Business & Management, vol. 7, no. 2, pp. 203-210.

Nguyen, H & Huynh, D 2012, ‘The contribution of social capital into the activities of real estate companies in Vietnam’, Journal of International Business Research, vol. 3, no. 1, pp. 53-59.

Ramnani, V 2017, ‘Demonetisation impact on real estate worse than 2008 Lehman crisis’, Hindustan Times. Web.

Rouanet, H & Halbert 2016, ‘Leveraging finance capital: urban change and self-empowerment of real estate developers in India’, Urban Studies, vol. 53, no. 7, pp. 1401-1423.

Saokhue Corporation 2015, Vietnam housing demand & supply status. Web.

Shatkin, G 2016, ‘The real estate turn in policy and planning: land monetisation and the political economy of peri-urbanisation in Asia’, Cities, vol. 53, no. 1, pp. 141-149.

Singh, R 2016, ‘India’s crazy housing bubble is definitely not bursting anytime soon’, Quartz India. Web.

Squires, G & Heurkens, E 2014, International approaches to real estate development, Routledge, London.

Vietnam foreign direct investment 2017. Web.

‘Vietnam in-depth PESTLE insights’ 2015, Vietnam Country Profile, vol. 1, no. 1, pp. 1-68.

Watson, V 2014, ‘African urban fantasies: dreams or nightmares?’, Environment and Urbanisation, vol. 26, no. 1, pp. 215-231.