Introduction

The demand for goods and services is influenced by various factors that exist in the community. Demand is influenced by the price of the good as well as the existence of an appropriate substitute. If two products are perfect substitutes of each other, then the production of one influence the demand of the other.

Corns as a source of energy have substitutes; one of its perfect substitutes is soya-beans. In their production, they are produced using similar factors of production, and their efficiency is assumed to be the same (Ruffin & Gregory, 1988). This paper analyses various elements of demand; it will focus on a case study of corns and soya beans, which are perfect substitutes.

If the demand for corn increases due to its use as an alternative energy source, what will happen to the supply of corn’s substitute such as soybean?

When demand for a product increases, then its price increases; this is because of the number of people who need the products increases. The relationship between demand and price follows an inverse trend. If the demand for a product increases, its price increases; on the other hand, if the price of a product decreases; then the demand for the product increases.

In our case, the price of corns has increased. When the demand for a substitute increases, it follows that the price of the other product decreases, in this case, the demand for soya-beans will decrease. Decreased demand leads to a decreased price of the good.

Farmers being rational are likely to produce that commodity that will give them higher returns. Rational farmers understand the trends in the market and make their decision with this in mind. In this case, since the cost of the product of either product has not decreased or increased, then he will consider the commodity that will offer more returns; in this case, it will be corns. Since factors of production are fixed and limited, they will substitute soya beans for corns; in what will be seen is a shift of production to meet the demand in the market.

They will be willing to produce less of soya beans for corns. When soya beans are produced in lesser quantities, then it means that their supply in the market will be reduced (Mas-Colell et al. 1995). Quantities supplied in the market are affected by the price of the commodity. If the price of a commodity decreases, then traders and farmers will be less willing to produce and sell the commodity.

This leads to a decreased supply of the said product. In this case, due to a shift of demand to corns, which happens to be a perfect substitute of Soya-beans, and assuming that the number of customers remains the same, then there will be a decreased number of customers who will demand Soya, the resultant is decreased cost.

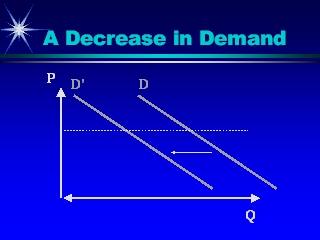

The graph below shows the decrease in demand for Soya beans as a shift to demand for its perfect substitute increases;

Let’s analyze the case of Corns graphically;

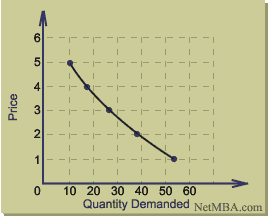

Assume that the graph below represents the demand of corns at the normal situation before its demand has been influenced by its new use;

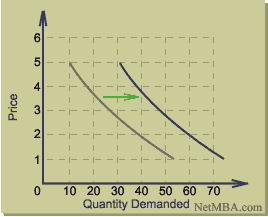

After the new development in the use of the product, then there will be a shift in the demand curve. See the graph below for the prospective shift;

Analyzing the graph above the price of corns has increased.

What will happen to the price of corn oil?

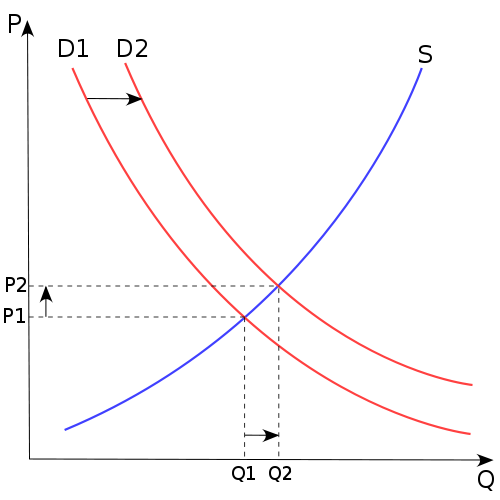

Demand increases the price of a commodity. There are numerous factors that affect the demand for a product. They include customer preferences, the income of customers, the presence of substitutes, and changes in tastes by consumers. In our case, there has been an invention of another function that corn oil can do. Customers are demanding more corns as they have more benefits than soya-beans. This is a customer driven demand. The resultant is an increase in the price of corns. Let’s analyze the situation graphically;

At a normal situation, the products demanded are Q1; they cost the customers P1 price. If there is an increased demand for corns, then the quantity demanded in the market will be at point Q2, the cost at this point is P2 cost. P2 cost is a cost higher than P1, and the change in price is (P2-P1). Q2, on the other hand, is higher than Q1, and the increased demand quantity is Q2-Q1. At this situation, we assume that the supply of corns remains constant.

How does the price elasticity of demand for corn oil influence the quantity-demanded of corn oil?

Price elasticity refers to the degree at which a change in price affects the demand for a product. When calculating price elasticity, other factors that affect demand are held constant, and it is assumed that only price affects demand. Mathematically;

![]()

It was derived by Alfred Marshall (Slavin, 2009).

The table below summarizes the five possible outcomes in a demand

If a commodity has a higher price elasticity to demand, it means that in case of a slight change in price, then there will be fewer good demanded. There is no commodity that is perfectly elastic or perfectly inelastic. In our case, since after the price of corn has increased, there will follow a decreased demand as the price is one factor that affects demand, there will be consumers who will not feel comfortable to buy at the increased price and opt for the substitute.

If a product has high price elasticity, it means that an increase in price leads to a high reduction in the demand of the commodity.

If a commodity is inelastic, it means that when its price changes, there is no change in the goods demanded. Depending on the level of inelasticity the effects will be felt differently (O’Sullivan & Sheffrin, 2003).

The Total Revenue earned by sellers of corn oil?

The effect of price elasticity of demand on the number of earnings that sellers get is dependent on the kind of elasticity that a commodity is going to get. When a commodity is elastic, that is a price change affects the amount of good demanded negatively, then the total earnings of the product decrease. It has an opposite direction trend where price increases but earnings decreases.

This is so because the amount of price that has increased in the product cannot compensate for the loss in quality demanded. In the case of an inelastic commodity, then an increase in price will lead to an increase in income to the suppliers. This is so because an inelastic commodity does not respond to changes in price, and consumers will continue to buy the commodity even if its price in the market has changed. In another way than the price and income from the product move in the same direction.

In the case of Corns, they are responsive to changes in price, if the price increases, the demand for the products will be reduced at a rate that is higher than the change in price. The resultant will be a shift to use low priced soya beans. Traders who had increased their production of corns will get a low income.

However, there is a possibility that corns will have an inelastic price elasticity of demand. This may be so because the new use of the product may be so useful to the consumers that they are willing to pay high for it; in this case, the incomes to the supplier/farmer will be increased (Krugman & Wells, 2005).

Conclusion

Demand and supply of goods and services are affected by various factors. The major determinant is price. On the other hand, the presence of a perfect substitute in the market affects the demand for a product when the other products demand is changed. An increase in price leads to a decrease in quantity demanded, and a decrease in price leads to an increase in quantities demanded. Their demands are dependent on each other. The degree to which a commodity responds to a change in price is called price elasticity of demand.

Reference List

Krugman, P., and Wells, R. (2005). Microeconomics. New York: Worth Publishers.

Mas-Colell, A., et al (1995). Microeconomic Theory. New York: Oxford University Press.

O’Sullivan, A., and Sheffrin, M. (2003). Economics: Principles in action. Upper Saddle River, New Jersey 07458: Pearson Prentice Hall.

Ruffin, J.; Gregory, P. (1988). Principles of Economics (3rd ed.). Glenview, Illinois: Scott, Foresman.

Slavin, L. (2009). Economics, 9th Ed. New York: McGraw-Hill.