Observing various branches of the United States market is a crucial part of many economic investigations. The electric vehicle charging station’s section is of significant interest in the current age, as it provides multiple possibilities for lucrative growth. This work presents an overview of the charging station market for electric vehicles in the US, explaining the industry’s organization and the strategies of delivering the products and services to the market.

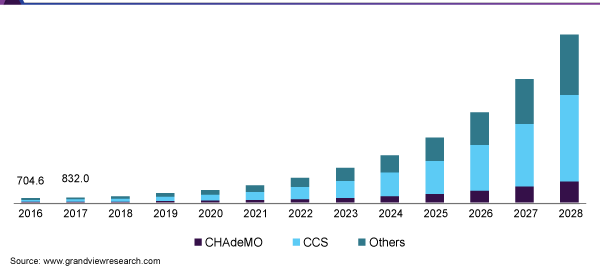

The United States infrastructure for electric vehicle charging is considerably sized, stating the value of 2.08 billion dollars in 2020. Due to the rising demand for electric vehicles, as well as their cost and energy efficiency, the overall growth of this industry is continuing, suggested to expand by 38.9% by 2028 (Grand View Research, 2021). According to recent reports, it is possible that by 2025 the number of electronic vehicles (EVs) used will reach 7.5 million (Mordor Intelligence, 2019). Such tremendous growth rates are dependent on several factors, primarily the increasing implementation of EVs, their accessibility, and the decreasing price of lithium-ion batteries, an integral part of this business. The general trend for this development is presented in Figure 1, comparing the previous years’ market sizes and the predictions for future advancements.

The history of the EV charging infrastructure is closely related to environmental preservation issues, specifically air pollution and energy consumption. To overcome the growing negative impact on the world’s climate, it is necessary to construct a low-cost energy-effective solution that could be adopted by multiple countries at once (Hall & Lutsey, 2017). The popularity of electric vehicles has been shown to grow steadily from 2013, as the USA government sought to implement the EVs as a potential resolution to the aforementioned difficulties (Hall & Lutsey, 2017). The market’s organization is constructed on the charging options available, enveloping alternate-current (AC) charging levels 1, 2, and 3 (Mordor Intelligence, 2019). As additional options, direct (DC) and inductive charging stations are also available, however, the majority of the infrastructure utilizes AC charging levels 1 and 2, largely dominating the industry (Mordor Intelligence, 2019). Other market segments include charging stations variety by vehicle installation and charger types.

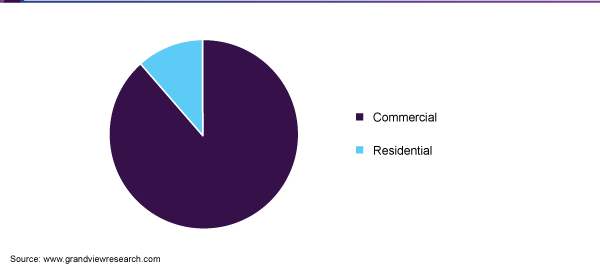

The electric vehicle charging station market in the US was tremendously supported by the government, which initialized various investments to increase the industry’s growth. The state endorsed the installation of different charging stations in collaboration with multiple electric companies, prompting the application of public charging points (Grand View Research, 2021). Such points are primarily installed by organizations involved in the electrical power business, for example, BTC power or General Electric company, which supply the charging devices and participate in the assembly process (Grand View Research, 2021). The general supply chain involves numerous businesses to provide the materials for battery and station construction, mostly relying on international production (AEE, 2020). The charging equipment manufacturing distribution is presented in Figure 2. Altogether, delivering materials and products to the US market is a complex process, requiring collaboration between various global corporations and the United States government.

To conclude, the basic principles of the USA’s electric legal charging station market were examined in this paper. The industry explored is significantly affluent in the contemporary environment, presenting considerable size and potential growth trends. The market’s organization appears to be primarily based on the AC charging levels 1 and 2, which dominate the DC alternatives. Furthermore, the US portion of the market currently lacks local production, adhering to numerous international resources and including other companies in station construction and installation.

References

Advanced Energy Economy (AEE). (2020). A supply chain is growing for electric transportation. Here’s what it could do for one state.. Energy Central. Web.

Grand View Research. US electric vehicle charging infrastructure market report, 2021-2028. Web.

Hall, D., & Lutsey, N. (2017). Emerging best practices for electric vehicle charging infrastructure. International Council on Clean Transportation. Web.

Mordor Intelligence. (2019). The United States electric vehicle (EV) charging equipment market: Growth, trends, and forecast (2020—2025). Web.