The incremental costing approach is among the best well-known strategies employed by banks and firms to determine the price of their commodities. There are six main characteristics of incremental costing. To begin, the costing approach is used to examine the influence of unit-level costs on the overall quantity or frequency of demand and supply (Liu et al., 2016). Second, and most importantly, the break-even analysis estimates the number of sales that will produce an equivalent revenue or profit margin. Third, contribution per entity calculates the overall input of each commodity and from diverse sectors in order to calculate overall revenues. Fourth, the unit-level cost and input must be equal to the item’s selling price. Fifth, among the most generally used strategies for determining the value of inventory, is the costing methodology, particularly the task in progress section. Finally, the costs are divided into two categories: unit-level costs and indirect costs. The expenses that are deemed quasi or dynamic are classified as either variable or indirect costs. (Liu et al., 2016). Below is the computation of the incremental cost of the Shetland knitwear firm based on the owner’s stated output of 3000 units.

Table 1: Unit-level cost (per unit)

Incremental cost of manufacturing 1 unit = total cost of 3000 – (unit-level cost of extra unit + total cost)

Unit-level cost per unit = 618,750 / 3000 = 206.25

= 206.25 + 1,135,000

= 1,135,206.25

= 1,135,206.25 – 1,135,000

= 206.25

So, in my opinion, the incremental costing strategy is not the best option for the knitwear firm to use because it has several drawbacks. First, the incremental costing approach ignores the manufacturing element in favor of focusing solely on the marketing and revenue functions (Sotiriou et al., 2019). Second, it is also stated that when a company utilizes an incremental costing procedure to estimate the cost of its goods. The inventory levels are essentially underpriced, and the devaluation of current assets can cause significant complications and drawbacks for enterprises that utilize this model to identify the value of their merchandise (Sugiyama et al., 2019). Third, the time component and the modifications that time delivers are entirely ignored by this approach (Eory et al., 2018). This results in a financial delinquent since, as time passes, many various market alterations occur, such as shifts in consumer demands and inflationary pricing, among others.

Furthermore, analysts argue that in the end, this incremental costing strategy is not helpful since it frequently fails to give its consumers a detailed response. As a result, if a corporation is needed to keep external data for its constituents’ groups, these incremental costing methodologies are unsuitable (Varian, 2016). Automation is a significant issue that can contribute to the collapse of this method’s implementation. As automation is now being utilized by numerous multiple organizations to do their projects in an optimized approach when the mechanization is completed, the indirect costs will undoubtedly rise, and this fact is widely overlooked by the incremental costing system, making the reliability of this valuation method controversial.

If the knitwear company utilizes the incremental costing procedure as a costing system, this will create a serious challenge when the firm works on cost-plus contractual agreements because the pricing of the merchandise is established per the operating income, so when the cost-plus contractual arrangements are made, the fixed-rate will trigger a significant challenge for the knitwear corporation (Varian, 2016). Amidst several benefits, such as improved decision-making, the incremental costing approach has many downfalls (Heathfield & Wibe, 2016). In this case, the incremental costing methodology should be used in conjunction with standard costing or budget costing procedures (Drury. C & Drury. L, 2018). Therefore, the organization can produce optimal outcomes through costing strategies.

Costing Technique

As per my subjective view and expertise of costing methodologies, the company must apply the total costing model to determine unit pricing. Dooley, a corporate scholar, proposed the total costing hypothesis. Per this theory, the cost of generating a specific amount of output must be the complete aggregate summation of all various types of expenses spent in order to create that specific number of items in an economical way (Aorora, 2021). Based on this cost theory, two categories of expenses are employed to compute the total, variable, and indirect costs, and the equation is as shown in:

Total costs = unit-level costs + indirect costs

When it comes to indirect costs, they stay constant regardless of output rate. Even though zero units might be produced, these costs must be borne and cannot be averted. Examples include: Rent, utility expenses, and office costs are just a few examples. A firm’s indirect costs are the total of all the overt and covert costs incurred by the firm (Volz et al., 2020). When it pertains to unit-level costs, these are the costs that fluctuate depending on the degree of manufacturing that the firm is undertaking. These costs are classified as the core cost of the industry and the conversion cost expenses of the company since they are directly correlated to the creation of the service provider’s commodities (Lai & McCulloch, 2017; Mundada et al., 2016). Direct unit-level costs include, among other factors include labor and material costs and licensing fees.

The main advantage of using the total costing technique is that it considers the complete cost of manufacturing a company’s goods. The total costing approach provides a completely defined statistic that anyone can readily understand and evaluate in order to examine the profit circumstances of the firm (Ho, 2020). Conversely, this may be utilized to conduct a protracted analysis of the firm’s pricing and cost.

Recommendation for a Selling Price

The costing approach that will be adopted to estimate the selling price of the knitwear firm items is markup pricing, in which a specific markup will be applied to the cost of merchandise to establish their values, and the costing price that will be applied is total valuations.

Current Year Price

Unit cost = unit-level cost + indirect costs

Wool price (28.50) + labor price (30 * 5.5) 165 pounds plus freight costs (4.50)

The total unit-level cost is 198 pounds.

Indirect expenses are calculated as follows: head office costs ($100,000) + director salary ($125,000) + advertising (115,000)

total indirect costs =340,000

Unit cost = 198 + 340,000/2000

= 198 + 170

Unit cost = 368 pounds

Profit margin price = unit Cost/1-desired return on sales total indirect costs

Profit margin price = 368 / 1 – 0.25

= 490.66 pounds

Next Year Price

Unit cost = unit-level cost + indirect costs

Wool cost (28.50) + labor cost (30 * 5.5) 165 (1+0.05) 173.25 + transportation cost (4.50)

Total unit unit-level cost = 206.25 pounds

Indirect costs = head office costs (100,000) + director salaries (125,000 (1+0.05) + advertising (285,000)

Total indirect costs = 516,250

Unit cost = 206.25 + 516,250/3000

= 206.25 + 172.0833

Unit cost = 378.33

Markup price = unit Cost/1-desired return on sales

For example, if the desired return on the sales is equal to 0.25

The markup price will be as follows:

Markup price = 378.33 / 1 – 0.25

= 516.44 pounds

Break-Even Analysis

A break-even assessment is an accounting method used to calculate the number of items or sales amount required by a company to pay its entire variable and indirect costs. Shareholders and government regulatory agencies typically have access to this intrinsic management tool, which is different from data processing. Financial firms, on the other hand, may request it as a component of lender loan assessment economic forecasts. Fixed or variable costs are taken into consideration in the formula. It is also impossible to change the price of a product or service if the fixed costs stay the same. Mortgage payment or personal loan on an institution, capital equipment, wages, interests on investment, real estate taxes, and insurance payments are all examples of indirect costs.

As sales fluctuate, so do the costs that are subject to change. Direct unit labor salary costs, revenue commissions, and costs for raw materials, infrastructure, and transportation are all examples of variable costs. To put it another way, variable costs are the total cost of producing one unit of a product. The equation below will be employed to calculate the breakeven analysis:

Indirect costs / (sale price of one unit – the unit-level cost of one unit)

Break-Even Analysis of this Year

- Indirect costs = 340,000

- Unit-level cost per unit = 198

- Selling price = 490.66

When all of them are combined in the above-mentioned formula, the following outcomes will be obtained:

- 340,000 / (490.66 – 198)

- = 340,000 / 292.66

- = 1161.75 to reach the breakeven threshold of units to be sold.

Break-Even Analysis of Next Year

- Indirect costs = 516,250

- Unit-level cost per unit = 206.25

- Selling price = 516.44

When all of them are combined in the above-mentioned formula, the following outcomes will be obtained:

- 516,250/ (516.44 –206.25)

- = 516,250/ 310.19

- = 1664

To reach breakeven in the next year, 1664 units must be sold.

Marketing Section

The Shetland Wool Corporation has a wealth of opportunities and can perform better than how it is currently performing if some strong and successful prospective initiatives are implemented. In order to develop a strong approach for the firm, we must examine the macroeconomic and microeconomic aspects of the industry (Küçük et al., 2021). The major instrument that we may employ to analyze the internal circumstances of the firm is to do a SWOT analysis of the organization. So that we may gain an understanding of the organization’s corporate circumstances and identify what the firm’s organizational abilities, flaws, prospects, and risks are.

SWOT Analysis

Referring to the Shetland Wool Firm’s strengths, the main strength of the corporation is that it is powered and regulated by a central family unit. This is an attribute because conflict resolution in this sort of market is straightforward as most business owners are constructed on unity, which leads to fewer disputes (Erdogan et al., 2020). It also implies that decision-making protocol is easy when likened to a public corporation where slight changes necessitate a large foresight (Chua et al., 2018). Conversely, the firm has a small group of workers that are devoted to the business. Therefore monitoring them and meeting their requirements in order to encourage them to be productive is a relatively simple process when compared to a formal organization.

Weaknesses

In my opinion, the company’s main weakness is its inability to grow. Because the assets cannot be traded on financial markets to raise funds, it may be difficult for the company to get capital for its operations because it is a privately owned business. While digitization may be an option for the business, the costs involved may be prohibitive for the time being. (Sebastian et al., 2020; Kabeyi, 2019). Furthermore, it is shown that industry is primarily handled and overseen by family members, but if the corporation desires to develop, the support of external expertise and abilities is also needed, which is a complicated job to have in the framework in which the business operates, and the cost structure of the firm is also ineffective and inefficient to accomplish for the company.

Opportunities

The present potential for the corporation is that the customer and market for the items with which the firm interacts are increasing as individuals seek to improve their living conditions. However, during the winter condition, and if the firm is successful in marketing its commodities in a comprehensive and expedient manner, the company’s revenue may improve. Another option for the company is to expand into international trade markets since there is a growing preference for jumpers made from Shetland wool in several areas. For instance, there is a large market share in countries found in the Middle East and Asia, so expanding into those markets may be very beneficial.

Threats

So far, the primary challenges to the firm are the difficulty to secure adequate capital to finance its activities in the foreseeable and the failure to control its cost levels.

Micro and Macro Analysis

To assess the business’s micro and macroeconomic health, one must first investigate the current market conditions in which the firm operates. The Shetland Wool Corporation is now functioning in the United Kingdom, which has one of the world’s greatest economies and individuals who invest more in their leisure and lifestyle than the rest of the global financial system. Currently, there are several difficulties and economic situations that might have an impact on the industry’s well-being. Therefore, it is necessary to perform a PEST analysis.

PEST Analysis

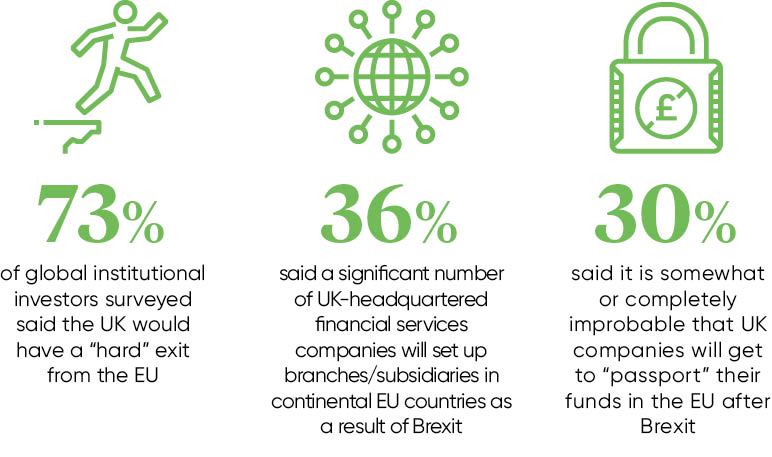

The primary political aspect that may have an impact on the Shetland Wool Company is Brexit. Brexit is the phrase that may be employed to refer to the United Kingdom’s decision to end the European Union. It implies that firms in the United Kingdom no longer profit from trade gains acquired for Brexit as a consequence of being a member of the European Union’s monetary union (Gallagher, 2020). It is probable that the enterprise may be subjected to protectionist measures when engaging in business with Great Britain’s European business partners. For instance, Ireland and France are two Nations that export massive amounts of wool to the rest of the globe, and if the Corporation imports wool from these nations, the cost of exports and raw materials would undoubtedly rise, affecting the firm’s manufacturing costs.

Economic Factors

The economic development of several nations has stalled because of a Covid-19 and Brexit. The diagram below (see Figure 1) indicates the perception of U.K. citizens on the effect of Brexit.

Covid -19 has also had a disastrous impact on companies in the U.K. This is owing to the voluntary closure of global trade to limit the speed of viral transmission (Diseases, 2020; Mangani, 2021). Because the changes in cumulative demand are lower, this could be an advantage for the Shetland Wool Company, as they are undoubtedly selling sweaters at lower prices than some such well-known brands in the country as Marks, Spencer, and Zara, and if they preserve value and reliability (Gibb et al., 2020; Mikolai et al., 2020). In this case, the popularity of their sweaters could rise.

However, it can be observed that the British pound, the currency of the U.K., has risen and appreciated by 4%. This might have both positive and negative consequences for the firm. (Ehwi et al., 2021; Yeboah et al., 2021) If the Company exports some of its raw goods, it will benefit from the appreciation because the commodities will be inexpensive when likened to before. However, one drawback is that when the sterling pound is strong, foreign imports will become affordable for U.K. residents (Welfens, 2017). Therefore, the firm may consider purchasing foreign acquired branded products rather than those manufactured within the country.

Concerning the labor force numbers, it is noticed that the rate of joblessness in the U.K. is growing. In 2019, it was 4 percent, and in 2021, it is approximated to be 4.5 percent (Gkiouleka et al., 2018). This can be regarded as one of the adverse effects of the Covid-19 disease outbreak (Gnevko, 2020; Pratsinakis et al., 2020). However, for the Shetland Wool Corporation, this incident can actually demonstrate to be favorable since, with higher underemployment, citizens of the U.K. may embrace working for lower wages.

Social Factors

Social factors may have an influence on the Shetland Wool Enterprise. In the U.K., there is a tendency to wear clothes like a nobleman, and a higher percentage of adults, in particular, opt to wear an official and respectable costume rather than torn jeans and bomber jackets. Therefore, this cultural aspect can help the Shetland Wool Firm if the business only enhances a favorable impression of itself in the supply chain and generates high brand equity. As such, there might be an increase in its sales as the U.K. is the largest market for the self-preservation of this type of business. Many people in this nation are highly conscious of their culture and want elevated services and commodities, and because the Shetland Wool Business wants exceptionally high-end Shetland wool, its commodities may be sold successfully in the U.K.

On the contrary, the winter period has started, and the average temperature in the U.K. commonly drops significantly throughout this time of year. Therefore, it is certain that the clamor for winter gear, of which sweaters are also a core component, will rise. The result is a significant impact on business as well as its purchases, which can blossom with a considerable prevalence during such a time of year.

Technological Factors

Great Britain is among the most economically sophisticated nations in the universe, and the latest innovation is freely accessible in this region of the world. The Shetland Wool Factory has access to advanced machinery that may be used to create high-end quality sweaters. This will cost the firm some revenue, but it will have numerous advantages for the organization as well. With the employment of technology, the enterprise will be capable of removing all of its labor expenditures, and this cash can be utilized elsewhere to support the company’s other functions.

Automation, on the contrary, is more adaptable than manual labor because the manufacturing cost can conveniently be lowered and enhanced when utilizing manufacturing and production processes. This is essential for the firm because the popularity of the brand will be dependent on the weather. Though the clamor for sweaters is only in the cold season, there is very little or no demand for knitwear in the warmer months. Therefore, for a corporate like this, these versatile channels of production are very crucial.

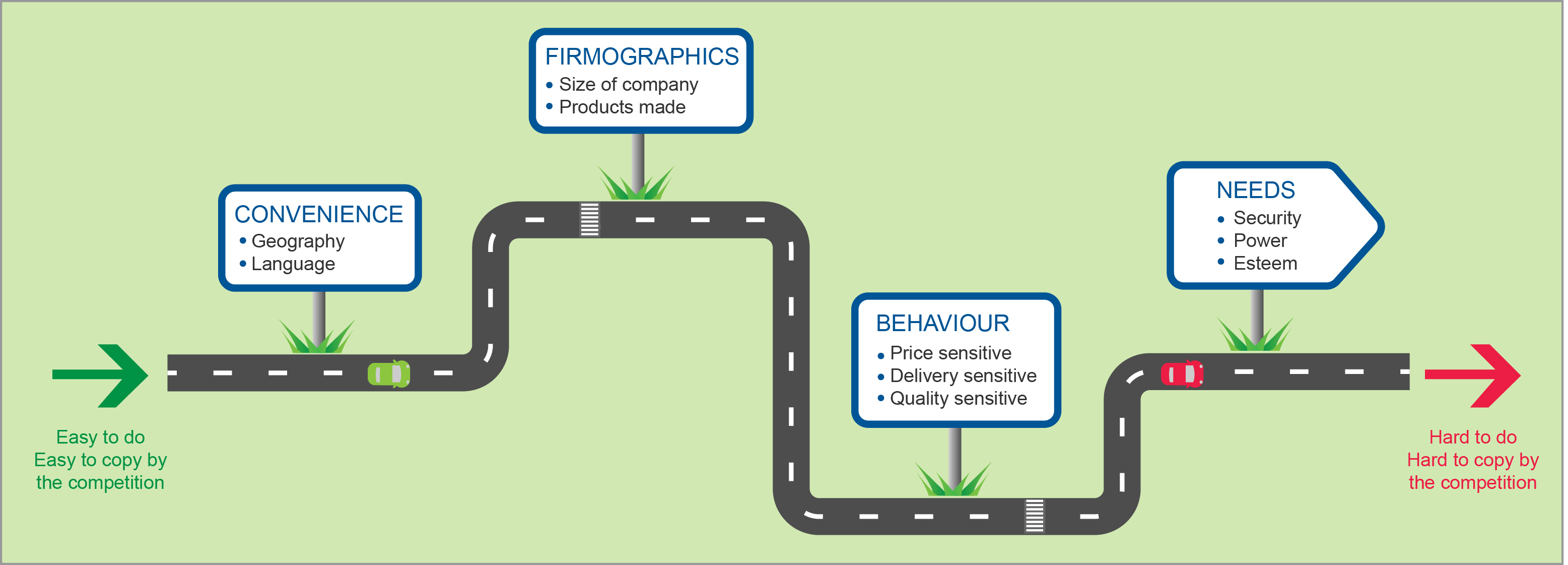

Market Segmentation

Businesses must split their overall market target into subsets based on distinct qualities to focus solely on the target populace of the region. These subsets are sometimes referred to as segments or target markets (Dolnicar et al., 2018). The Company will also need to stratify its citizens so that advertising campaigns can be implemented for them. The Factory management can divide the market into four ways, which are as shown:

Table 2: Segmentation Matrix

Sporty Segment

However, London is chosen because the individuals in London are deemed wealthier than many of the U.K., so they will be capable of paying premium prices for Shetland Wool Merchandise, which can be exorbitant considering the quality that is utilized to generate sweaters and knitwear. Furthermore, the U.K. has some of the top sports events, such as the English Premier League, which would draw athletic wearers to Shetland Wool Company’s products (Swanson, 2021). Nevertheless, because of branding, most sportsmen prefer attire that meets the needs of their advertisers, such as Adidas and Nike. In this situation, the company will urge the player’s clothing suppliers to dress on its sweaters and knitwear. Glancing at the focus age categories, it can be said that the Company’s attention or focus audience rests over almost all age groups spanning from young teens to elderly individuals. In winter, almost everyone adorns sweaters because it is a key component of U.K. culture. For instance, sleeveless and elegant garments form part of the nation’s contemporary fashion pattern.

Everyday Wearers

The average wearer is largely concerned with the climate patterns of the garments they wear throughout the day. As a result, one of the geographical sub-segments of the Shetland Wool Company’s intended audience is the environmental weather condition. In this scenario, the weather of that topographical location is the primary criterion examined by the Shetland Wool Company in order to separate the community geographically. The colder the location, the more concentrated the corporation will be on the local people. According to geographical differences, the targeted group will consist of the following sections of the broader U.K.: (1) Scottish highlands, (2) Northern Ireland, (3) London, (4) the Shetland Islands, and (5) the Orkney Islands. So the inhabitants in the above-mentioned locations live in one of the coldest parts of the U.K., and they are the primary target region for the Shetland Wool Company. In this case, the consumers will require more warm clothing, such as sweaters, than individuals in any other part of the U.K.

Another justification for selecting these zones as key priorities for the Shetland Wool Company is that residents demand sweaters even during the summer months because the climatic condition in such areas as Scottish highlands is lower than the rest of the U. K. Therefore if the corporation is capable of building its brand reputation there, it will be proficient of scoring a decent spot where its product lines will be demanded even during the summertime.

Fashion and Budget Conscious

London is also selected as the people in London are considered to be richer than most of the other parts of the united kingdom, so they will be easily able to pay premium prices for products of the Shetland Wool Company, as they can be expensive due to the quality that is being used in order to produce sweaters and knitwear. However, the U.K. also constitutes a majority of budget-conscious because of the high number of retirees and family grouping (Perelli-Harris & Blom, 2021). In this case, the firm will have a better segment to deliver its budget-friendly sweaters and knitwear.

Analysis of the Target Audience

Speaking of the clothing sector in the U. K, of which the Shetland Wool Company is also a core component. It is approximated to be among the major sources of gross domestic product, and transactions of this economy are anticipated to develop gradually (Shahbandeh, 2021). Online networking is the primary promotional approach that a firm may use (Braun & Eklund, 2019). In the U.K., the trend of online purchases is spreading on a massive scale. Only for the items on Instagram, the royalty percentage is the same as 13%, which is outstanding, especially for a considerable interest organization like the Shetland Wool Company (Phillips, 2021). People in the age bracket of 14-19 years old and 20-28 years old are frequent users of internet media attractions like Facebook and Instagram and are influenced by online news and advertising campaigns. Hence, this can be a rational framework for the Shetland Wool Company to guide its enterprise. The Shetland Wool Company’s offers are high-end quality, reasonably affordable sweaters.

Marketing Mix

The marketing mix is a collection of advertising techniques used to entice people to buy a firm’s commodities and services. It is based on the four p’s concept, with each P representing a distinct and vital section of marketing strategy, and they include (1) Price, (2) Placement, (3) Promotion, and (4) Product. The figure below shows the 4P’s that are commonly found in the business market for strategic management.

For pricing, most companies opt for the method by charging low prices in order to capture the market and increase its share. When the Shetland Wool Company develops its name, it can charge premium prices afterward. Furthermore, the corporation can provide periodic discounts throughout the summer period in order to sell its inventory during the off-season, which is the hottest month (Milman et al., 2021). For placement, the corporation can offer its items digitally or through its various avenues for placement.

A promotion strategy is used to conquer the market and expand one’s stake. In this case, an industry’s pricing structure must be to charge competitive pricing in terms of promotion. In this regard, when the Shetland Wool Company’s name becomes well-known, it will be able to demand higher prices. Finally, product structure encompasses when Shetland Wool Firm offers a high-end quality with reasonably priced sweaters.

References

Aorora. M. N. (2021). A textbook of cost and management accounting (11th ed.). Vikas Publishing.

Braun, J. A., & Eklund, J. L. (2019). Fake news, real money: Ad tech platforms, profit-driven hoaxes, and the business of journalism. Digital Journalism, 7(1), 1-21. Web.

Chua, J. H., Chrisman, J. J., De Massis, A., & Wang, H. (2018). Reflections on family firm goals and the assessment of performance. Journal of Family Business Strategy, 9(2), 107-113. Web.

Diseases, T. L. I. (2020). Challenges of coronavirus disease 2019. The Lancet. Infectious Diseases, 20(3), 1-2.

Dolnicar, S., Grün, B., & Leisch, F. (2018). Market segmentation analysis: Understanding it, doing it, and making it useful. Springer Nature.

Drury, C., & Drury. L. (2018). Cost and management accounting. Cengage Learning.

Ehwi, R. J., Maslova, S., & Asante, L. A. (2021). Flipping the page: Exploring the connection between Ghanaian migrants’ remittances and their living conditions in the U.K. Journal of Ethnic and Migration Studies, 1-24. Web.

Eory, V., Pellerin, S., Garcia, G.C., Lehtonen, H., Licite, I., Mattila, H., Lund-Sørensen, T., Muldowney, J., Popluga, D., Strandmark, L., & Schulte, R. (2018). Marginal abatement cost curves for agricultural climate policy: State-of-the art, lessons learnt and future potential. Journal of Cleaner Production, 182(1), 705-716. Web.

Erdogan, I., Rondi, E., & De Massis, A. (2020). Managing the tradition and innovation paradox in family firms: A family imprinting perspective. Entrepreneurship Theory and Practice, 44(1), 20-54. Web.

Gallagher, T. (2020). Europe’s path to crisis. Manchester University Press.

Gibb, J. K., DuBois, L. Z., Williams, S., McKerracher, L., Juster, R. P., & Fields, J. (2020). Sexual and gender minority health vulnerabilities during the COVID‐19 health crisis. American Journal of Human Biology, 32(5), 1-9. Web.

Gkiouleka, A., Avrami, L., Kostaki, A., Huijts, T., Eikemo, T. A., & Stathopoulou, T. (2018). Depressive symptoms among migrants and non-migrants in Europe: documenting and explaining inequalities in times of socio-economic instability. European Journal of Public Health, 28(5), 54-60. Web.

Gnevko, S. (2020). U.K. Challenger Banks’ Market Cools Down in Recession-Conditions and Scenarios. Journal of Accounting & Finance (2158-3625), 20(4), 151-164.

Harrison. P, & Hague. M. (n.d.). Market segmentation in B2B markets. B2B International. Web.

Heathfield, D. F., & Wibe. S. (2016). An introduction to cost and production functions. Macmillan International Higher Education.

Hilton. A. (2017). Brexit and political risk in U.K. business. Raconteur. Web.

Ho. P. (2020). Nonlinear pricing, biased consumers, and regulatory policy: When living with bias is better [Unpublished doctoral dissertation]. JEL Classification. Web.

James. D. (2021). What are 4Ps of the marketing mix. GalaxyTechnoSpace. Web.

Kabeyi, M. (2019). Organizational strategic planning, implementation and evaluation with analysis of challenges and benefits. International Journal of Applied Research and Studies, 5(6), 27-32. Web.

Küçük, H., Lenoël, C., & Macqueen, R. (2021). 1 U.K. economic outlook: Brisk but not better growth. National Institute Economic Review, Vol. 256. Cambridge University Press

Lai, C. S., & McCulloch, M. D. (2017). Levelized cost of electricity for solar photovoltaic and electrical energy storage. Applied Energy, 190(1), 191-203. Web.

Liu, Z., Wu, Q., Oren, S. S., Huang, S., Li, R., & Cheng, L. (2016). Distribution locational marginal pricing for optimal electric vehicle charging through chance constrained mixed-integer programming. IEEE Transactions on Smart Grid, 9(2), 644-654. Web.

Mangani, A. (2021). When does print media address deforestation? A quantitative analysis of major newspapers from U.S., U.K., and Australia. Forest Policy and Economics, 130 (1), 102537. Web.

Mikolai, J., Keenan, K., & Kulu, H. (2020). Intersecting household-level health and socio-economic vulnerabilities and the COVID-19 crisis: An analysis from the U.K. SSM-Population Health, 12 (1), 1-9. Web.

Milman, A., Tasci, A. D., & Panse, G. (2021). A Comparison of Consumer Attitudes Toward Dynamic Pricing Strategies in the Theme Park Context. International Journal of Hospitality & Tourism Administration, 1-23. Web.

Mundada, A. S., Shah, K. K., & Pearce, J. M. (2016). Levelized cost of electricity for solar photovoltaic, battery and cogen hybrid systems. Renewable and Sustainable Energy Reviews, 57(1), 692-703. Web.

Perelli-Harris, B., & Blom, N. (2021). So happy together… Examining the association between relationship happiness, socio-economic status, and family transitions in the U.K. Population Studies, 1-18. Web.

Phillips. A. (2021). 23 Ways to easily increase Instagram engagement in 2021. Falcon. Web.

Pratsinakis, M., King, R., Himmelstine, C. L., & Mazzilli, C. (2020). A crisis‐driven migration? Aspirations and experiences of the post‐2008 south European migrants in London. International Migration, 58(1), 15-30. Web.

Rotheram, S., Cooper, J., Barr, B., & Whitehead, M. (2021). How are inequalities generated in the management and consequences of gastrointestinal infections in the U.K.? An ethnographic study. Social Science & Medicine, 282 (1), 114131. Web.

Saliminezhad, A., & Bahramian, P. (2021). The role of financial stress in the economic activity: Fresh evidence from a Granger‐causality in quantiles analysis for the U.K. and Germany. International Journal of Finance & Economics, 26(2), 1670-1680. Web.

Sebastian, I. M., Ross, J. W., Beath, C., Mocker, M., Moloney, K. G., & Fonstad, N. O. (2020). Strategic Information Management. Routledge.

Shahbandeh, M. (2021). U.K. wool industry – statistics & facts. Statista. Web.

Sotiriou, C., Michopoulos, A., & Zachariadis, T. (2019). On the cost-effectiveness of national economy-wide greenhouse gas emissions abatement measures. Energy policy, 128(1), 519-529. Web.

Sugiyama, M., Fujimori, S., Wada, K., Endo, S., Fujii, Y., Komiyama, R., Kato, E., Kurosawa, A., Matsuo, Y., Oshiro, K., & Shiraki, H. (2019). Japan’s long-term climate mitigation policy: multi-model assessment and sectoral challenges. Energy, 167(1), 1120-1131. Web.

Swanson. B. (2021). Premier League clubs to discuss shirt sponsors featuring gambling companies. Sky Sport. Web.

Varian, H. R. (2016). Intermediate microeconomics with calculus: A modern approach. W.W. Norton & Company.

Volz. U., & Morgan. P.J., & Yoshino. N. (2020). Routledge Handbook of Banking and Finance in Asia. Taylor & Francis Group,

Welfens, P. J. (2017). The true cost of Brexit for the U.K.: A research note (No. disbei234) [EIIW working paper, University of Wuppertal]. Palgrave Macmillan.

Yeboah, T., Boamah, E. F., & Appai, T. P. (2021). Broadening the remittance debate: reverse flows, reciprocity and social relations between UK-based Ghanaian migrants and families back home. Journal of International Migration and Integration, 22(1), 47-68. Web.