Introduction

Organizational leadership plays a significant role in steering growth and profitability. Wall-Man Inc. is an international company operating in eight states in the U.S. and six countries in Europe. The company’s mission is to become the world’s desired paint manufacturer. The corporation is strictly guided by U.S. and global corporate laws given its multinational operations. The company’s Board of Directors is crucial for its decision-making and routine management. Although the organization has its constitution, the U.S. corporate law on fiduciary duties of corporate leaders binds its management. This document gives, in detail, the structure, desirable attributes, appointment, roles, and fiduciary duties of the Board of Directors. Moreover, the document explores the business judgment rule and its potential impact on the Board’s decisions. Therefore, this document is significant guidance to Wall-Man’s Board of Directors.

Structure and Composition of the Board

Wall-Man Inc. aims to increase shareholders’ value at the end of every fiscal year. Consequently, the organization has adopted a corporate structure that defines the various positions held by the management officials. The Board of Directors is at the apex of decision-making within the company. While the Board may make decisions as a group, a clear-house organization is crucial. As a large corporation operating in six European countries and eight states in the U.S., the Board is structured in such a manner that the interests of all jurisdictions are met. Additionally, the adopted structure promotes inclusivity and diversity, which is one of the corporation’s core values. Therefore, the Board is composed of ten members, each representing the company’s areas of operations.

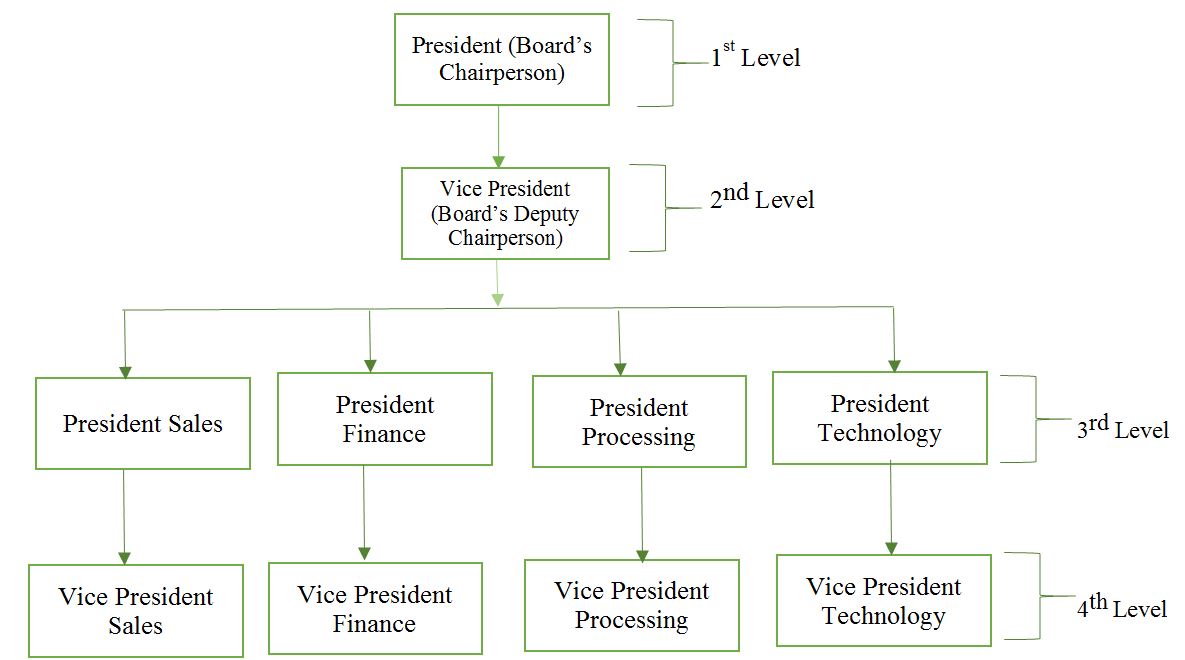

At the top of the Board’s structure is the president who is its chairperson. The president is elected by the majority’s shareholders. However, a candidate for the position of president is subject to a thorough interview, conducted by the selection committee as stipulated under article 10(a) of Wall-Man Inc.’s constitution. The president is deputized by the vice president who acts as the deputy chairperson during Board’s meeting. Under the vice president are the presidents of the company’s four crucial departments of sales, processing, finance, and technology. Each of the departmental presidents is deputized by the vice presidents who are routinely interchanged across all the organization’s jurisdictions. Figure 1.0 below, shows a pictorial representation of Wall-Man’s Board of Directors structure.

Desirable Attributes of the Board Members

Wall-Man Inc. prioritizes the desires of majority shareholders and other relevant authorities. Consequently, each Board member undergoes an intense recruitment process that is guided by the corporation’s goals and constitution. Successful organizations recruit Board members with a certain level of nous and compassion. The company’s constitution, under article 31(2)(c) provides that the selection committee must rank probable Board members based on emotional intelligence, ability to commit, bravery, and passion. Each of the Board members must have the attributes described below.

President (Board’s Chairperson)

The president is the head of the company and chairperson of the Board of Directors. Therefore, various attributes are crucial for smooth decision-making and leadership. In terms of the internal business environment, the president must be conversant with the routine operations, organizational structure, the constitution, and employees’ needs in various departments. In terms of the external environment, the president must be informed of the laws and regulations of various jurisdictions in which the company operates. Additionally, the president must own several set shares according to the company’s constitutions, a majority is desired. Furthermore, the president is required to have achieved a tertiary level of education with no criminal records.

Vice President (Board’s Deputy Chairperson)

The vice president deputizes the Board’s chairperson and is significant in influencing organizational decisions. The vice president needs to understand the various employees’ roles and the recruitment process. Externally, the vice chairperson must understand the dynamic economic conditions, legal, and political climate circumventing the company. Owning shares is required of the vice president, but there is no set minimum number of stakes. Furthermore, the vice president must be educated up to the tertiary level. The Vice president’s background should be an ethical and successful career without criminal records.

Departmental Presidents

Unlike the president and the vice president, departmental presidents are selected solely based on personal competencies. Therefore, there is no set minimum number of shares required from them. However, they must be shareholders in the company and worked with it for at least three years. Additionally, they must be competent in their operational areas which must be proved by their corporate and academic achievements. The departmental presidents must be aware of the routine internal business operations.

Departmental Vice Presidents

The departmental vice presidents are selected based on their historical achievements in their specialty areas. While there is no set minimum number of stakes required, they must be shareholders of the company. As assistants of the departmental presidents, they must be aware of internal business issues in their departments. Moreover, the vice presidents must know the external business environment likely to impact their departments. A minimum educational level of the university, with an added advantage of a degree in their specialty areas, is required.

Role of the Board in the Management of the Corporation

The Board of Directors plays significant roles in the direct and indirect management of Wall-Man Inc. The Board is in charge of making the crucial and final decisions that impact the business operations. Additionally, the Board is involved in the organization of various important events for the company. As a corporate body guided by its constitution and the various corporate laws within and without the U.S., the Board members have different roles depending on their level of management (figure 1.0) as listed below.

President (1st Level)

- Is the company’s chief executive officer in charge of all the internal managers and supervisors

- Approve the organization’s daily financial expenditure as presented by the chief accountant

- Gives directions to the supervisors in the fourteen company branches

- Heads and calls for ad hoc meetings in case of emergencies

- Signs organizational budget upon the Board’s approval

- Represent the company in various events at local and international levels

4.0.2 Vice President (2nd Level)

- Assigns duties to departmental supervisors in fourteen branches

- Assigns duties to the departmental presidents

- In charge of Board of Directors meetings in case the president is absent

- Assign duties to various stakeholders as directed by the president

- Temporarily takes over the role of the president in case of death or incapacitation

Departmental Presidents (3rd Level)

- Coordinate departmental supervisors in various branches

- Assign roles to the departmental vice presidents

- Write reports on departmental performance and give recommendations on areas for improvements

- Assign routine duties to supervisors of various departments

- Execute roles as assigned by the president or the vice president

Departmental Vice Presidents (4th Level)

- In charge of departmental supervisors in the fourteen branches

- Write weekly reports to the departmental presidents

- Assign duties to supervisors and junior employees

- Are in charge of sales, technology, processing, and finance

- Execute any role as assigned by the leaders in the 1st, 2nd, and 3rd levels

- Recruit and dismiss employees in their specific departments

Fiduciary Duties

The Board of Directors executes various duties that are aimed at business growth and profitability. Although some of the decisions can be publicly declared to shareholders, some cannot be in the corporation’s interest. Therefore, the company’s constitution, in line with national and global corporate law, imposes various fiduciary duties on the directors. The duties are imposed upon the Board when exercising discretionary powers that may lead to a conflict of interests. The four main fiduciary duties of the directors are as discussed below:

Duty of loyalty: this duty is owed by the directors to the company. The duty requires the director to always act in the interest of the organization when executing their various roles as discussed above.

Duty of care: this duty is owed by the directors to the company and employees. The duty requires the directors to make judgments that do not jeopardize the business. Additionally, they should ensure that the employees operate in a friendly working environment that does not risk their lives.

Duty of non-disclosure: this duty is owed by the directors to the company, shareholders, and employees. The duty requires the directors not to share any confidential information with external parties. The company’s constitution requires the directors not to disclose the company’s information such as secret codes with external persons and competitors unless required by the law. Additionally, the duty encumbers the directors from sharing employees’ and shareholders’ information with third parties. Protected information includes personal details, number of shares, and net worth, among others.

The Business Judgment Rule

The Board of Directors may face frivolous lawsuits when acting in the interest of the company. Wall-Man Inc. operates in countries that are guided by English Common law. The company abides by the doctrines of the Common law that protects the directors. The business judgment rule of Wall-Man Inc. presumes that the directors act in good faith when making decisions. The directors are expected to act within their fiduciary duties and set standards of loyalty. The rule impacts the directors in two major ways depending on the kind of decisions they make. First, the directors cannot be sued in their capacities if their decisions are solely within the ambit of their fiduciary duties. Instead, the company takes the blame for its decisions if need be. Second, the directors are sued in their capacities if their decisions are inconsistent with fiduciary duties. The company excuses itself from the blame, letting the directors face legal charges.

Conclusion

The Board of Directors is in charge of management activities at Wall-Man. The directors are classified into four levels of management, each with specific duties in the daily operations of the company. The president of the Board is the CEO of the company and gives directions to other leaders. Meanwhile, the vice president deputies the president in various capacities. Departmental presidents are uncharged of sales, finance, technology, and processing. The directors are required to obey their fiduciary duties to avoid the negative impact of the business judgment rule. Wall-Man’s constitutions and directors’ roles make it remain competitive in the market.