Introduction

The world economy has undergone economic slump in the past few years due to the global recession. The UAE’s economy has undergone a slump in its growth rate as the economy registered a modest growth rate of 2.3 percent in 2016. The global economic downturn resulted in a slackening of growth of real GDP of the UAE. The oil shock resulted in a drop of the real GDP growth from a handsome 5 percent average growth rate of 2010-2014. The government reacted by adopting austerity measures to fight the economic slowdown, resulting in further weakening of the economy. Austerity measures dampened consumer confidence, reducing demand for credit, which in turn adversely affected businesses. The average rate of inflation in the UAE had increased from 0.8 percent in 2011 to 4.1 percent in 2015, which in turn reduced to 3.3 percent in 2016 (World Bank, 2016).

Another problem faced by the country’s economy was the sustained low prices of oil in the global market that deteriorated the balance of external trade and fiscal deficit. Further, the reduction of the revenue from the oil and petroleum sector affected the economy adversely (Mankiw & Rashwan, 2012). The government took measures to boost economic growth. It reduced its reliance on government deposits and issued $5 billion in Euro-bond in April. However, these measures failed to boost the lackluster growth rate. The fiscal balance was further pushed down from 10.4 percent of GDP in 2013 to 2.1 percent in 2016 (World Bank, 2016). This reduced growth rate and bad fiscal condition as due to the global recession and lower price of oil in the worldwide market. The current account surplus enjoyed by the country fell from 19.1 percent of GDP in 2013 to 3.3 percent of GDP in 2015 and to 1.3 percent in 2016 (World Bank, 2016). Tightening of monetary policy in response to the austerity measures taken by the government, resulted in further deteriorating economic growth.

According to the World Bank outlook, the growth rate is expected to slow further to 3 percent in 2018 (World Bank, 2016). This paper aims to understand the state of GDP, unemployment, and inflation in the UAE.

Literature Review

Is it possible to sustain the growth process of a country over a long period of time when it operates in an open economy? In the case of the UAE, is the country’s growth sustainable given the current state of global economy and low prices of oil worldwide? In order to answer these questions, we need to identify and understand the economic indicators that will help to predict the sustainability of economic performance of the country. To answer these questions, we need to concentrate on three specific economic indicators – inflation, unemployment, and its effect economic growth rate or GDP growth. This will help us to identify the economic indicators that affect and facilitate the economic growth process of the country. Before we undertake this analysis, the paper will provide a brief overview of the economic indicators and how they may help us to identify the economic condition of the UAE.

Economic indicators are used to interpret the current situation of the economy and indicate the future. These indicators help to ascertain the health of the economy of the nation. Economists use these indicators as parameters to track the changes that take place within the economy that in turn helps to understand if the economic condition is improving or deteriorating. Based on these findings, they provide policy recommendation to the government.

Economic growth means the rise in the economy’s total production of goods and services over a period. This is measured as a percentage increase in GDP, which is expected to improve the quality of life of the people. GDP growth occurs when there is advancement in technology, which in turn increases production, the rise in literacy rate of the country, and/or increase in capital stock of the country. GDP growth usually occurs when the economy employs new technology or allows specialization of labor, utilizes newly discovered resources, invents new production methods, increase in the size of working population, and increase in trade (Ossman, 2016). Depending on the nature of economic growth and the indicators that help in growth, the country faces other side effects such as the fiscal or monetary deficit, budgetary deficit, trade deficit, environmental costs, inequality of income, and/or inflation. Economic growth is often accompanied by inflation. However, the two may not occur together. For instance, in the UAE, the increased investment is oil sector is expected to increase production and therefore boost real GDP growth. However, this will increase inflation as well (World Bank, 2016). It is believed that economic growth can occur without inflation if the growth of aggregate demand is sustained and balanced.

Thus, the austerity measures after the onset of the global recession resulted in dampening of consumer demand thus reducing aggregate demand and thus, rising inflation. However, high revenue and profit from oil export can create a balance between aggregate demand growth and inflation. However, prices of oil prices fell, reducing the profit from oil revenue, thus affecting the balance. According to the Harrod-Domar model of economic growth, the equilibrium of economic growth is balanced on the edge of a knife even in the long run (Solow, 2016; Halsmayer, 2014). According to the classical growth theories, if the capital output ratio and savings ratio fell even slightly it resulted in inflation and/or unemployment for a long period (Assous, 2015). If the rate of labor force increases, capital-output ratio and savings ratio may fall. The consequence of such a fall is either a lengthy inflation or a rise in unemployment rate. Due to the absence of change in technology, the natural growth rate of the economy and the unemployment rate of labor force are affected. Further, economic growth also depends on saving and investment done by households.

Unemployment rate is a measure of the number of people who do not have a job as a percentage of the total number of people in the workforce. When the unemployment rate is high, it reduces the spending capacity of the population, resulting in lower spending by consumers and has a negative impact on the GDP and consumer market. In order to boost consumer spending, government debt can increase due to higher spending in assistance programs and stimulus spending. Unemployment rate shows the health of the labor market of an economy, explaining of it has been functioning. High unemployment can pose a high cost on the labor force, economic growth, and inflation.

Inflation shows the increase in the price of essential goods and services in an economy. It refers to the ratio of the amount of money supply to the economy and goods and services available in the economy. The higher is the ratio, indicating higher money supply than the available goods and services, it indicates a higher inflation and vice versa. A sustaining high inflation may devalue the currency of the country. When inflation is high, it leads to reduce the average standard of living of the economy, as it reduces the purchasing power of the consumers. Moreover, inflation also results in a rise in unemployment. However, moderate level of inflation is believed to positively influence investment rate in the economy as it keeps the interest rate and consumer spending at a moderate level. If the inflation occurs unexpectedly, it may affect the workforce, the savings of the people, and those who receive a fixed income. On the other hand, business houses may reap higher profit due to the rise in prices, without the liability of increasing wages. Nations can plan to increase or decrease inflation by employing fiscal or monetary measures.

However, sustained inflation can reduce business investment in the economy thus hampering growth. Thus, higher inflation implies lower investment, thereby, reducing productivity. The Phillips curve shows the reasons why a high level of unemployment is not good for the economy. However, it also shows that a full employment level is practically unattainable. Various economic factors can affect the productivity gains and that zero inflation or unemployment are not viable in the long-run (Kremer, Bick, & Nautz, 2013). Therefore, the aim is to get the equilibrium level of inflation and employment. The unemployment remaining in the economy over and above this employment rate is actually the labor force that could not get a job, as their skills did not match that of the employers. This indicates that the economy has to revamp its technology and develop training method to help improve the required skills.

Literature suggests that economic growth (which is calculated in terms of rate of growth of real GDP), unemployment rate, and inflation. The relation between inflation and unemployment has been established through Phillips curve and it states that if the economy tries to attain zero inflation or deflation, they will end up increasing unemployment (Ormerod, Rosewell, & Phelps, 2013). On the other hand, a high rate of inflation will also increase unemployment. Further, inflation has a strong negative effect on economic growth, which in turn affects employment. The paper will next look at how the three economic indicators affect the UAE economy.

The UAE Economy

The UAE economy has experienced a slowdown in growth largely due to the fall in the oil prices. Due to the recession of the global economy and fiscal consolidation policy adopted by the UAE government that aimed to diversify the nation’s earnings from different sources, there was a slump in the growth of the country. This section deals with the three specific economic indicators and shows how their change has altered the fundamentals of the economy.

GDP

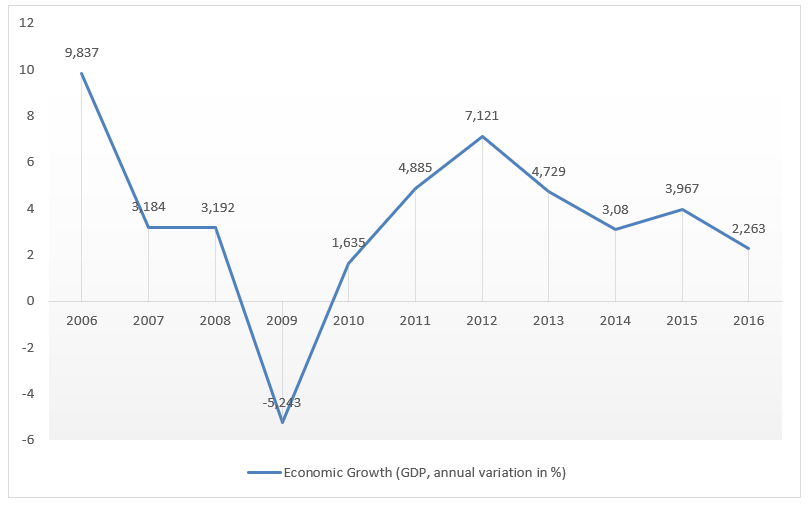

The GDP growth rate as shown in figure 1 points out that the growth rate of GDP in the UAE has decreased considerably since 2006. The growth rate slumped to a negative amount of -5.2 percent indicating a fall in GDP of the country (IMF, 2016). The GDP growth rate in 2016 was estimated to be 2.26 percent (IMF, 2016; World Bank, 2016). This is a significant drop from the pre-oil shock average growth rate of 5.6 percent from 2011 to 2013 (IMF, 2016). The government adopted austerity measures in order to reduce government spending and curtail the fall in growth rate. However, these policies adversely affected consumer confidence, which in turn weakened business. This also reduced the private sector borrowing rate.

Figure 1 shows the annual rate of change in GDP, which is termed as GDP growth. This is a significant indicator of economic growth. This figure shows that the UAE has been facing growth crisis since 2009 right after the global economic crisis started. In 2009 the growth rate slumped to a negative value of -5.2 percent. From 2010 to 2012, the economy saw growth in GDP however, it again started falling since 2013. This fluctuation of GDP growth in a span of 10 years can affect the economy adversely. It also shows how the economy has been functioning during this time.

The fall in the GDP growth is caused by the following factors – (1) global economic recession and (2) lower oil prices. As the global economy was in recession, UAE’s open economy too was significantly affected by the turndown. Growth in developed countries was subdued, resulting in the decline in growth in the developing and emerging economies. However, this resulted in a slight increase in GDP in the first half of 2015, as shown in figure 1. In addition, the sustained decline in the oil prices resulted in a decline in the fiscal and external balance. Policy makers have tried fiscal consolidation as a measure to reduce the fiscal gap, but have not been completely successful. Some of the fiscal measures adopted by the government are increasing tariffs on water and electricity, reducing tariffs such as that of fuel and reducing government transfers to Government Related Entities (World Bank, 2016). However, the fall in the oil prices has affected the economy badly as the country’s GDP is strongly dependent on the income from the hydrocarbon sector. Thus, the economy’s fiscal surplus as a percentage of GDP reduced from 10.4 percent in 2013 to 2.1 percent 2015 and 3.5 percent in 2016.

Intuitively, it can be deduced that the slump in oil prices has reduced the growth rate of the economy. This indicates that the economy is dependent on the income from the oil sector. When the oil prices fell, it reduced income from the oil sector, adversely affecting economic growth. The UAE government has started to expand its businesses into non-oil sectors in order to safeguard the economy from future oil shocks (World Bank, 2016).

GDP is one of the most important economic indicators as it shows the nature of growth of the country. It shows the total value of the products and services produced in the country. When the rate of growth of the products produced increases over a period, it shows a sustained growth. However, this growth rate reduces than that of the previous period. This implies that the GDP has not increased at the same rate as that in the previous period. When the GDP growth rate becomes negative, it shows that there has been a fall in overall GDP. Such a fall indicates that the economy’s performance ahs deteriorated significantly.

Inflation

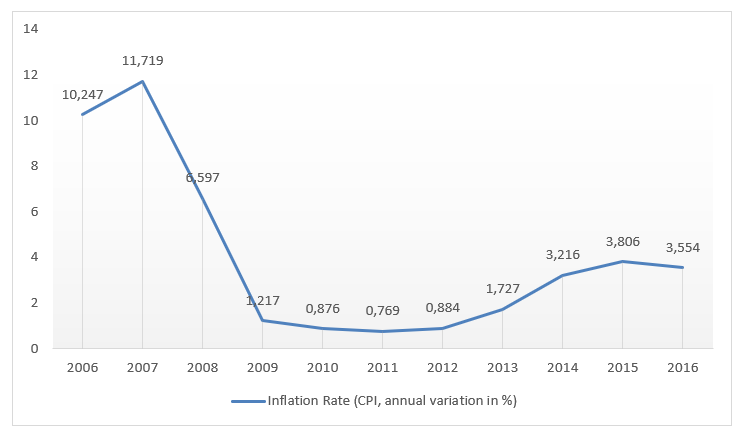

Inflation for the UAE is calculated from the annual percentage change in CPI. The inflation rate of the UAE was very high in 2006 and 2007 when the average inflation was 11.5 percent. However, since 2008, inflation has declined considerably and reached an average of 0.95 percent from 2009 to 2012. However, as shown in figure 2, the inflation rate started rising since 2013 through 2016. A rise in inflation indicates that the economic growth is unable to meet the demand and there is more money in the economy than there are goods and services. Such a situation gives rise to higher demand and higher prices. However, the inflation rise has not been very high and there has only been a moderate increase. The average inflation from 2014 to 2016 is 3.07 percent. This shows that the recent rise in inflation rate has been significantly high (almost 228 percent when compared to the annual rate from 2009 to 2012). Such a high rise in inflation is probably due to the oil shock.

Inflation rates show stability from 2009 to 2012. However, since 2013 a rise in inflation rate indicates financial instability reducing chances of attracting new investment in the economy. The stable inflation rate of 2009 to 2012 showed that the financial market was stable and the real estate prices were under control. However, with the rise in the inflation rate from 2013, there has been a sudden rise in housing prices. Upward pressure on inflation in the UAE is probably due to a higher cost of daily consumptive goods like food and alcohol and higher education cost.

Unemployment

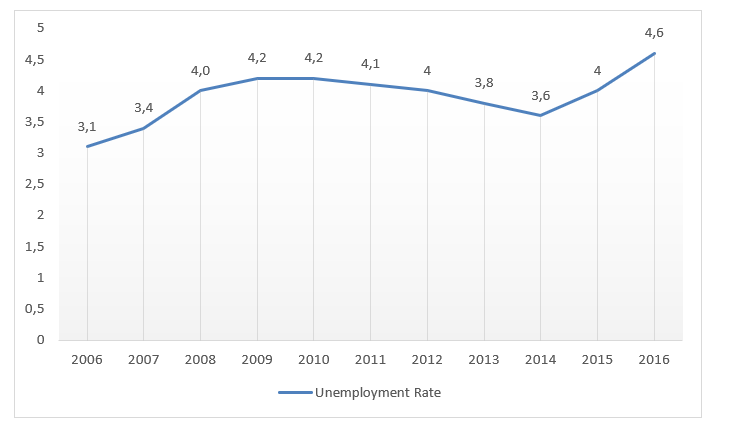

Unemployment rate shows the number of people looking for a job. Here, the number of people is not related to the total population but related to the total workforce. Therefore, the unemployment rate is the percentage of people actively looking for a job as a percentage of the total workforce. The unemployment rate of the UAE has been increasing. It has increased by 28 percent in 2016 when compared to 2014 unemployment rate. Such a high increase in unemployment may be due to the increase in inflation and fall in GDP growth.

Figure 3 shows that the unemployment rate of UAE shows that there is a high rate of the workable population employed. When compared to other GCC countries, UAE’s unemployment rate is the lowest (IMF, 2016). The development plans and policies by the UAE government ensure high absorption of the labor market and helps keep unemployment under check. However, the unexpected rise in unemployment rate creates pressure on the economy and growth.

Conclusions and Recommendations

Inflation and unemployment rate are the indicators that affect the GDP and GDP growth. With changes in inflation, rate and unemployment rate the GDP growth rises or falls. Therefore, when the inflation is higher it exerts pressure on the economy as it shows that the prices are increasing indicating higher demand while there is not enough production to meet the rising demand. Similarly, higher unemployment rate may exert negative pressure on economic growth.

The rising unemployment rate indicates that the recent policy of the government to diversify the economic operations to the non-oil sector is creating a gap between the available skills in the economy and the requirement of the new industry. Hence, it is important to create a new educational system to educate the workforce with the requirement of the new sector. Otherwise, the unemployment rate will increase creating greater pressure on the economy.

References

Assous, M. (2015). Solow’s struggle with medium-run macroeconomics, 1956–95. History of Political Economy, 47(3), 395-417.

Halsmayer, V. (2014). From exploratory modeling to technical expertise: solow’s growth model as a multipurpose design. History of Political Economy, 46(1), 229-251.

International Monetary Fund. (2016). IMF Economic Outlook UAE. Web.

Kremer, S., Bick, A., & Nautz, D. (2013). Inflation and growth: new evidence from a dynamic panel threshold analysis. Empirical Economics, 1-18.

Mankiw, G. N., & Rashwan, M. H. (2012). Principles of Economics. Abu Dhabi, UAE: Cengage Learning.

Ormerod, P., Rosewell, B., & Phelps, P. (2013). Inflation/unemployment regimes and the instability of the phillips curve. Applied Economics, 45(12), 1519-1531.

Ossman, G. (2016). Economic indicators in united arab emirates: assessing the sustainability of the country’s economic performance. Advances in Economics and Business 4(5), 208-221.

Solow, R. M. (2016). Resources and economic growth. The American Economist, 61(1), 52-60.

World Bank. (2016). United Arab Emirates Economic Outlook. Web.