Introduction

In the industry of beverage manufacturing, Coca-Cola is undoubtedly the leading organization. For more than a century now, the company has had a solid history of success and glory, thanks to the company’s exemplary business strategy. Although the company started by producing and selling sweetened carbonated beverages, it now manufactures more than 200 different types of brands. Some of its most dominant brands include Fanta, Coke, Sprite, Costa Coffee, Dasani, and Smart water.

Mission Statement

Coca-Cola’s mission statement is the roadmap that guides it on what to do. It illustrates the company’s idea and purpose as well as the endeavors that it puts in place to ensure that it accomplishes all its fundamentals. Thus, Coca-Cola’s mission statement is “to refresh the world in mind, body, and spirit, to inspire moments of optimism and happiness through brands and actions, and to create core value and make a difference” (The Coca-Cola Company, n.d, par. 1). There are three primary elements that are highlighted in this mission statement. They include: refreshing the world, making a difference, and spreading optimism and happiness.

Core Values

Coca-Cola’s core values serve as a guide for the behavior of its employees and describe how the staff interacts with each other and with the outside world. Indeed, the company has a strong internal structure that has been essential for its survival and maintaining the top position in the beverage manufacturing industry (The Coca-Cola Company, n.d, par. 1). Through its outstanding core values, the company has continuously proven itself as a global iconic brand. Thus, Coca-Cola’s core values include leadership, collaboration, integrity, accountability, passion, diversity, and quality. The company values positive relationships within itself as well as with the outside world. It has structures that allow for the sharing of ideas among its employees to produce high-quality products. Coca-Cola has created an independent work environment where its investors and workers are encouraged to share ideas, be accountable, and do tasks.

Vision

The company’s vision communicates to the public the plans that the company has for its future business prospects (The Coca-Cola Company, n.d). Therefore, Coca-Cola’s vision is “to craft the brands and choice of drinks that people love, to refresh them in body and spirit. And done in ways that create a more sustainable business and better-shared future that makes a difference in people’s lives, communities and our planet.”

Competition Analysis

The performance review of each progressing year will assume the format of exploring the company’s competition analysis, simulation performance results, and performance analysis as discussed below.

Porter’s Five Forces

Coca-Cola’s competitive landscape is addressed by Porter’s Five Forces of competition. By analyzing these forces, one can measure the current position of the company. The forces include the threat of new entrants, the threat of substitutes, the bargaining power of buyers, and the bargaining power of suppliers.

The Threat of New Entrants

There is no doubt that Coca-Cola is one of the leading manufacturers of beverages in the whole world. With its prominent brand presence, the company has a global customer base. It is believed that Coca-Cola is one of the most famous words in the world (Sinclair and Wilken, 2009). It comes second after the word OK, reinforcing the fact that the company enjoys strong brand recognition (Gulati et al., 2017). This means that the company can pose a formidable challenge to any new entrant, especially those willing to do it on a global scale (Hideo, 2021). The beverage industry is highly competitive, and any new entrant is not assured of such benefits as economies of scale, which Coca-Cola extensively enjoys (Liebowitz, 2016).

There is no denying that the beverages industry is a high-yielding market that is prone to attract as many players as possible. With many players, it is expected that prices of commodities would be substantially lowered by both new and old manufacturers (Lvque, 2019). This will result in lowered profitability for all the firms operating in the market (Anders, 2013). Although the beverage manufacturing industry continues to welcome new entrants each year, it is proving to be extremely difficult to gain a foothold near that of Coca-Cola (Maamoun, 2020). To be able to gain the level of the brand that Coca-Cola enjoys, the new entrants would be forced to invest time and a lot of money in marketing activities.

Threat of Substitutes

Apart from competing with other soft drinks, Coca-Cola is forced to also compete with other beverages that consumers prefer other than its own. It is common for consumers to switch to different products that will fulfill the same needs that they get from Coca-Cola. This has the potential of reducing the company’s profit margins (Jain, 2016). Coffee, lemonade, and tea have been identified as some of the leading competing substitutes for Coca-Cola products. In recent years, consumers are increasingly becoming conscious of their health and wellbeing (Vučetić and Cox, 2018). Thus, substitutes such as fresh juices and smoothies are fast gaining traction.

Particularly, fruit juices, coffee, Pepsi, water, and milkshakes have given Coca-Cola a formidable challenge lately. One of the most effective ways of mitigating this threat is to expand the company’s product line. This can be achieved by introducing a diverse product portfolio such as non-carbonated drinks, for instance (The Coca-Cola Company, n.d).

Bargaining Power of Customers

As a business entity, Coca-Cola interacts and deals with various types of customers who possess different bargaining power levels. Examples of these customers include direct end-users, fast-food chain owners, and vending machines. Direct end-users have zero bargaining power since they purchase Coca-Cola products at fixed and constant prices. The fast-food chain owners have low to medium bargaining power since Coca-Cola is a highly demanded beverage in these joints. The same applies to vending machines stationed at movie theaters and malls. However, Coca-Cola is often forced to keep its prices fixed when dealing with these categories of consumers even if the costs of manufacturing keep on fluctuating.

Bargaining Power of Suppliers

To obtain raw materials, services, and labor, Coca-Cola is forced to work with many suppliers. The power enjoyed by these suppliers is what is referred to as their bargaining power (Slack and Lewis, 2019). A company as big as Coca-Cola must make long-term contracts with its suppliers. This is because an alteration in the cost of labor, services, and raw materials will automatically cause an increase in the cost of the company’s final products (Ciafone, 2019). For instance, if in a particular year, a region experiences a bad harvest, the cost of the products will automatically increase. This will not be good news of Coca-Cola since its aims to maintain the prices of its products at a constant rate. This is why it is important to have contracts to ensure that raw materials are supplied at a constant price. Huge companies such as Coca-Cola can easily shift their suppliers. However, the same cannot be said of suppliers willing to shift to new customers that purchase in bulks such as Coca-Cola. This means that the bargaining power of suppliers for Coca-Cola is low.

Competition

Since the late 19th century, Pepsi has been Coca-Cola’s main competitor. This is primarily because they manufacture products that are almost similar in looks and tastes. The two companies have different sets of competitive rivalry, which refers to the competitiveness that each of them has in the market over the other (Aswathappa, 2013). Pepsi owns and operates several brands of salty snacks such as Lays and Doritos, which is its critical advantage over Coca-Cola (Nestle, 2015). On its part, Coca-Cola has mainly stuck with its signature beverages. This means that if there will be a sudden drop in the demand for soft drinks, Coca-Cola will be adversely affected as compared to its main competitor, Pepsi. On the other hand, Coca-Cola also operates and owns several other beverage brands such as vitamin water and minute made (Griffin, 2021). This implies that if people will suddenly stop buying soft drinks, Coca-Cola has an alternative for them.

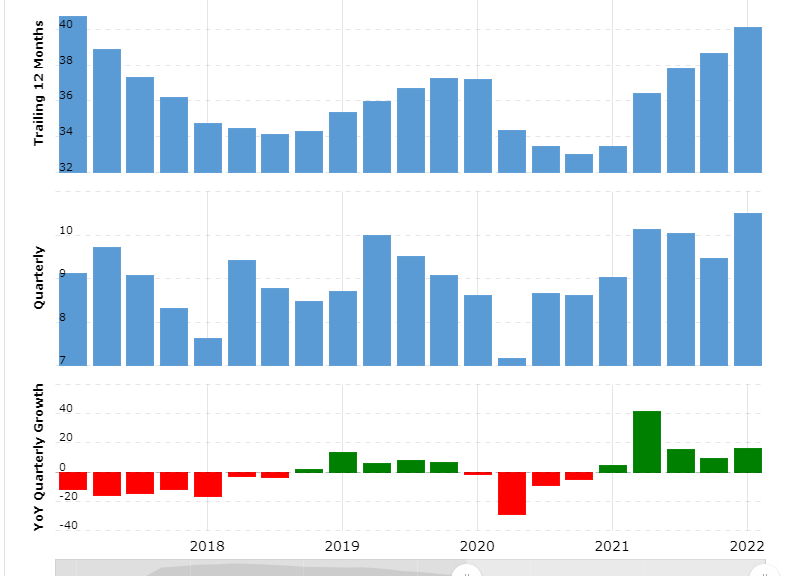

The history of Coca-Cola’s annual and quarter revenue and rate of growth from 2010 to 2022 is characterized by the amount of money it receives from its customers in exchange of goods sold to them and services rendered to them. Quarter ending March 31, 2022, Coca-Cola’s revenue was $10.491 billion, representing a 16.31% year-over-year increase. Twelve months ending March 31, 2022 Coca-Cola’s revenue was $40.126 billion, representing a 20.02 year-over-year increase (Carroll, 2022). The company’s annual revenue for 2021 was $38.655 billion, representing a 17.09% increase from the previous year. In 2020, it was $33.014 billion, but this was an 11.41% decline from 2019. Coca-Cola’s annual revenue for 2019 was $37.266 billion, which as an increase of 8.65% from the previous year.

Compared to its main competition, Pepsi’s net revenue as of the quarter ending March 31, 2022 was $4.261 billion, which represented a 148.6% increase from the previous year. For the twelve months ending March 31, 2022, it was $10.165 billion, indicating an increase of 35.61% from 2021. In 2021, Pepsi’s annual revenue was $7.61 billion, which represented an increase of 6.99% from 2020. The company’s net revenue for 2020 was $7.12 billion, which was also a decline of 2.65% from the previous year. In 2019, Pepsi’s net revenue was $7.31 billion, which was a 41.55% decline from the previous year (Slack and Lewis, 2019). From this comparison, it is clear that Coca-Cola has maintained a steady net revenue than its competitor, Pepsi.

Internal Capabilities (SWOT Analysis)

Strengths

One of Coca-Cola’s most formidable strengths is its brand recognition and validation throughout the globe. With this strong brand recognition, the company can easily introduce new product lines to ride on its brand reputation, which already enjoys established distribution networks and marketing programs. Indeed, the company has always taken advantage of this strength to introduce new products such as coffee and tea into the market (The Coca-Cola Company, n.d). This is exacerbated by the strong corporate culture that has earned it unrivaled customer loyalty. In addition, the company has a strong cash position and high-profit levels, a factor that it has taken advantage of when it comes to buying off new rivals.

Weaknesses

Coca-Cola’s main weakness is its overreliance on carbonated drinks, which have lately been associated with negative health implications. There has also been sustained negative publicity, especially regarding the high sugar content in its products. This continues to injure the reputation of the company and affects its profitability as a result (Blair, n.d). Furthermore, there are several brands that contribute very little to the overall company revenue (Gong, 2013). They only increase the operational costs but have minimal returns on investments.

Opportunities

Opportunities lie in the increase in demand for sugar-free products and alternative drinks such as tea and coffee. Other than its traditional markets, there has also been substantial growth in the size of emerging markets.

Threats

The fluctuating value of the US dollar against other currencies significantly affects Coca-Cola’s overseas operations. In addition, some countries have stringent legal requirements that affect the company’s marketing operations and bottling approaches.

Simulation Performance Results

Net Operating Revenues From 2007 to 2021

Coca Cola’s Finacial Report as of September 30, 2021

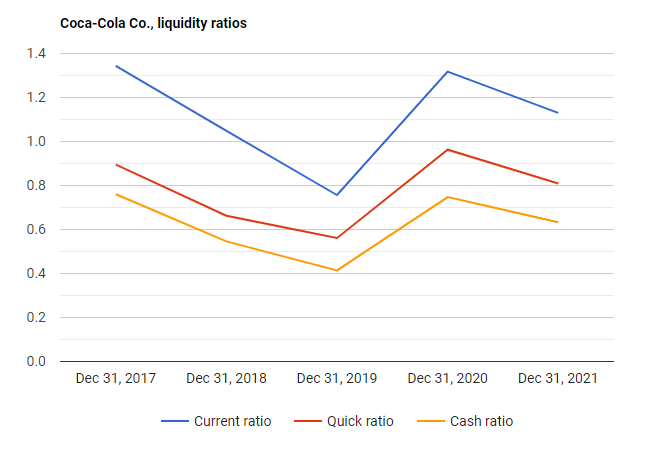

Liquidity Ratio

Coca Cola’s liquidity ratios measure the ability of the company to meet its obligation, albeit in the short term. They contain current ratio, quick ratio, and cash ratio.

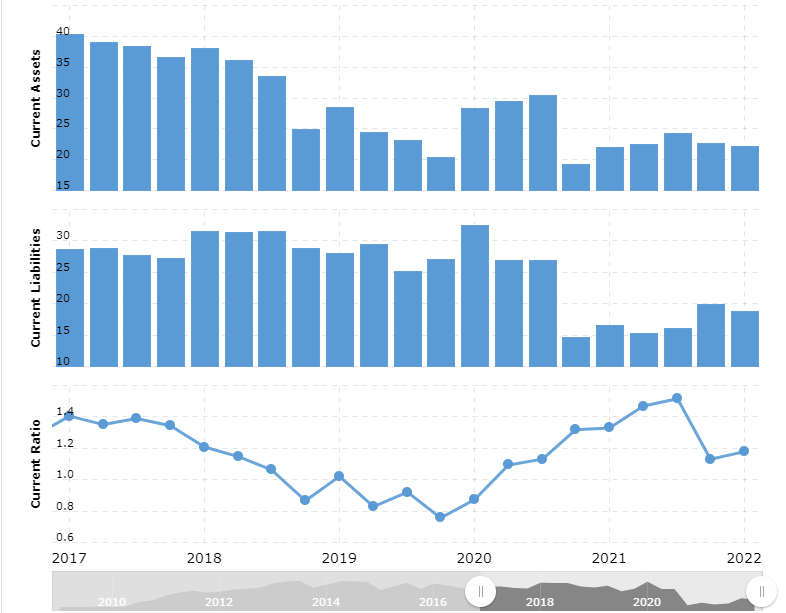

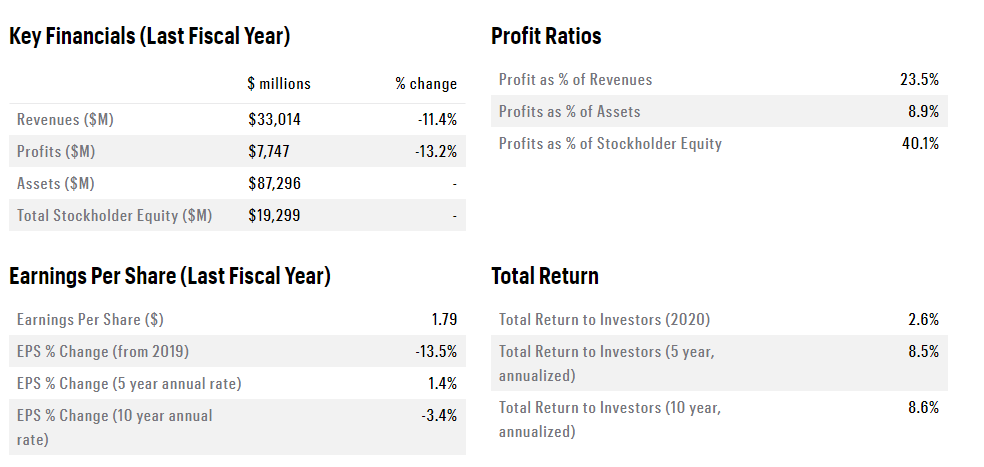

In the first quarter of the year 2021, Coca-Cola’s net revenue declined by 6% to $7.1 billion (Wang, 2020). This was mainly attributed to the effects of franchising of bottling operations owned by the company and currency fluctuations. On the other hand, the company’s organic revenue increased by 5%. This was driven by the 1% growth in concrete sales and the 4% price/growth mix. On its part, the operating margin expanded from 516 to 585 basis points (Çelik, 2017). The expansions of the margin were mainly attributed to lower-margin bottling operations divestitures (Butler and Tischler, 2016). Compared to the year before, cash flow operations went up by 6% to $7.3 billion as shown in the liquidity ratios. This means that Coca Cola’s liquid assets are increasing, hence providing a buffer against financial challenges. In 2021, Coca Cola’s net revenues surpassed its target by 17%. Although it was anticipated that the company’s net revenue would increase to $22.23 billion, it actually hit $38.7 billion (The Coca-Cola Company, n.d). Notedly, Pepsi recorded a decline in net revenue in 2019 and 2020. The better performance registered by Coca-Cola is attributed to its magnificent marketing strategy.

Strategy Evaluation

Coca-Cola mainly employs three strategies to drive up its products and increase sales. First, it targets people’s emotions to trigger a different reaction from them. The company has deliberately branded its products to appeal to people’s emotions mainly through nostalgia. Consumers of Coca-Cola are conditioned to feel reassured, secured, and satisfied with the product. Second, the company has always maintained a feel-good message that resonates with its target consumers (Wang, 2020). The focus of Coca-Cola’s message is to bring people together and create friendship. Third, over the years, Coca-Cola has been a subject of bad publicity especially pegged on its unhealthy food products. However, the company has responded to customers’ demands by coming up with new products that correspond to the dictates of the market. For instance, when there were sustained complaints of high sugar content in its products, Coca-Cola reacted by producing a new brand of sugarless Coke.

Marketing Strategy

Coca-Cola has built its marketing strategy around market segmentation by age, income, and family size. The company designs its ads with two categories of people in its mind; those between 10 to 35 years and those above 40 years of age (Palmatier and Stern, 2016). For those between 10 to 35 years, Coca-Cola uses pop stars and mainly pitch camps in universities, schools, and colleges. On the other hand, it also produces diet-conscious products for those above the age of 40 (Love, 2019). When it comes to family size and income, the company introduced different sizes and packaging for its products to include everyone. Various sizes come with different pricing labels to ensure that no one is left behind (Nganga, 2019). It is also important to note that Coca-Cola is present in more than 200 countries. Thus, it designs its marketing strategies by the culture, climate, and incomes of various regions.

Conclusion, Future Plans, and Recommendations

In recent years, there has been a dramatic increase in drinks as people’s demands also grow. This has seen several companies expressing interest to venture into the soft drinks and beverages manufacturing industry. This is an industry that has been primarily dominated by Coca-Cola and Pepsi (Verbeke, 2013). This means that the success of Coca-Cola as the leader in this industry is under threat. From the analysis above, it is apparent that Coca-Cola is in an advantageous position to maintain its top position in the industry (Antonetti et al., 2022). However, a lot still needs to be done if the company wants to sustain its leadership position for a long time (Bachmeier, 2009). Thus, Coca-Cola will be forced to change its strategy if it wants to continue thriving.

From the analysis of Porter’s Five Forces, it is apparent that Coca-Cola’s competitive advantage is superb. In the future, nonetheless, it plans to employ differentiation competition to augment its competitiveness. It is also planning to revamp its marketing approach to enhance its brand awareness, grow its customer loyalty, create value awareness, and develop more customer engagement (Davis, 2012). However, the success of these plans will depend on how the company will clean its image, which is becoming increasingly soiled by bad publicity (City, 2010). This is mainly due to the negative image that has been associated with its with regards to its unhealthy products. The following are the recommendations for the company:

- Diversify and optimize its product portfolio- the company should take advantage of its strong brand name and introduce healthy products to the market. This can be achieved through acquisitions and partnerships with existing organic brands. This way, Coca Cola will be able to redeem its image and make people regain confidence in its products.

- The company can build solid foundations by focusing more on consumer interests rather than profits- taking advantage of its strong global position, Coca-Cola can lead the way as a company that involves its consumers in selecting the most appropriate products.

- Coca-Cola should also invest more in research and development to identify innovative ways of producing environmentally friendly products.

- The company should take deliberate measures to ensure that its operations do not in any way compromise the environment. This can be achieved by focusing more on reducing plastic bottle production and encouraging recycling and reuse.

- Coca-Cola should consider venturing into the beer or the alcoholic industry the way Pepsi has done. This is because the company’s association with soft drinks over the years is slowly being challenged in recent times due to negative health implications.

Reference List

Anders, J. (2013) Coca-Cola’s marketing strategy: An analysis of price, product and communication. Munich: GRIN Verlag GmbH.

Antonetti, P., Rosengren, P. & baines, S. (2022) Marketing 6E. [S.l.] : Oxford University Press.

Aswathappa, K. (2013) Human resource management: Text and cases. New Delhi: McGraw Hill Education.

Bachmeier, K. (2009) Analysis of marketing strategies used by PepsiCo based on Ansoff’s theory. München: GRIN Verlag GmbH.

Blair, T. C. (n.d) The Effect of Coca-Cola and Pepsi impact on cross-culture brands communication. Oxford: Oxford University Press.

Butler, D. and Tischler, L. (2016) Design to grow: How Coca-Cola learned to combine scale and agility (and how you can too). London: Simon and Schuster.

Carroll , N. (2022) Coca-Cola marketers add innovation to ‘primary focus’. Web.

Çelik, U. (2017) International marketing strategy of Coca Cola Company: The essence and objectives of international marketing. München: GRIN Verlag.

Ciafone, A. (2019) Counter-Cola a multinational history of the global corporation. Oakland: California University of California Press.

City, N. W. (2010) How Coca-Cola got its fizz back. S.l.: Pearson Education.

Cocal Cola (n.d) Research on competitive strategy of Coca-Cola Company. Web.

Davis, J. A. (2012) The olympic games effect: How sports marketing builds strong brands. Hoboken: John Wiley & Sons.

Gong, Y. (2013) Global Operations Strategy. Berlin: Springer-Verlag.

Griffin, R. W. (2021) Management. S.I.: Cengage Learning Custom P,.

Gulati, R., Mayo, A. J. and Nohria, N. (2017) Management: An integrated approach. Boston: MA Cengage Learning.

Hideo, O. (2021) Coca cola coloring book: Coca Cola adult coloring books for women and men. S.l.: Independently Published.

Jain, V. K. (2016) Global Strategy: Competing in the Connected Economy. New York: Routledge.

Liebowitz, J. (2016). Beyond Knowledge Management: What Every Leader Should Know. London: CRC Press.

Love, J.. K. (2019) Soda goes pop: Pepsi-Cola advertising and popular music. S.l.: Ann Arbor University of Michigan Press.

Lvque, F. (2019) Competition’s new clothes. Cambridge: Cambridge University Press.

Maamoun, A. (2020) Coke versus Pepsi: 100 years of contention. London: SAGE Publications.

Nestle, M. (2015) Soda politics: Taking on big soda (and winning). Oxford; New York: Oxford University Press.

Nganga, C. (2019) Coca-Cola Company. History, SWOT analysis, maketing strategies. München: GRIN Verlag.

Palmatier, R. W. and Stern, L. W. (2016). Marketing Channel Strategy: An Omni-Channel Approach. New York: Routledge.

Sinclair , J. and Wilken, R. (2009) ‘Strategic regionalization in marketing campaigns: Beyond the standardization/glocalization debate.’ Continum, 23(2), pp. 147-157.

Slack, N. and Lewis, M. (2019) Operations strategy. Upper Saddle River: Pearson.

The Coca-Cola Company, (n.d) Growth Strategy. Web.

The Coca-Cola Company, (n.d) Long-Term Growth Potential. Web.

Verbeke, A. (2013) International Business Strategy. Cambridge: Cambridge University Press.

Vučetić, R. & Cox, J. K. (2018) Coca-cola socialism: Americanization of Yugoslav culture in the sixties. Budapest; New York, NY: Central European University Press.

Wang, Y. (2020) Essays in Industrial Organization: The Effects of Vertical Integration on Prices and New Product Introduction. Los Angeles, Calif.: University of California, Los Angeles.

Appendix

Business Plan

In 2021, Coca Cola’s net revenues surpassed its target by 17%. Although it was anticipated that the company’s net revenue would increase to $22.23 billion, it actually hit $38.7 billion. This means that the soft drinks manufacturer demonstrated unrivaled flexibility and resilience. Therefore, following the same trend, it is prospected that the company’s net income and profit will maintain an upward trajectory over the next five years. The year to year increments have not been computed using any factors but just prospections based on the current financial performance.

The computations are based on the current company’s financial performance.

Coca-Cola Current Ratio 2010-2022 | KO