Analysis of Current Market

The overall picture with negative profit shows that the potential of the products is far from being exhausted, as evidenced by the increase in sales forecast, most noticeable in product 1 and product 3, and both industries. According to sales, the costs of various investment and advertising channels are growing, requiring a change in the corresponding solution to obtain a positive gross and net profit in financial terms. Nevertheless, it is possible to cover all these disadvantages by entering the Asian market, which immediately caught up with the increased European one by half in sales compared to the first round. Given that the FR Tech lineup is one of the most diversified, product improvement should be sought in qualitative aspects, not quantitative ones: the technological growth rate of the smartphone market is increasing every year (Seo et al., 2019).

Market Outlook

Entering the Asian market gives more prospects to high-end companies that can afford expensive products with improved battery life and performance. At the same time, the significant presence of several companies in the market creates serious competition, keeping product prices down and stimulating the market (Huang & Jiang, 2018). Large companies enable FR Tech to enter a new market with significant sales, and a diversified lineup presents opportunities to enter different market segments, including the consumer. Given the trend of markedly higher prices in pursuit of a higher quality product with longer battery life, strong sales may serve as an incentive to keep prices low relative to competitors for the end consumer further to capture the market (Park, 2021). The latest smartphone designs are already pretty expensive purchases for the most part.

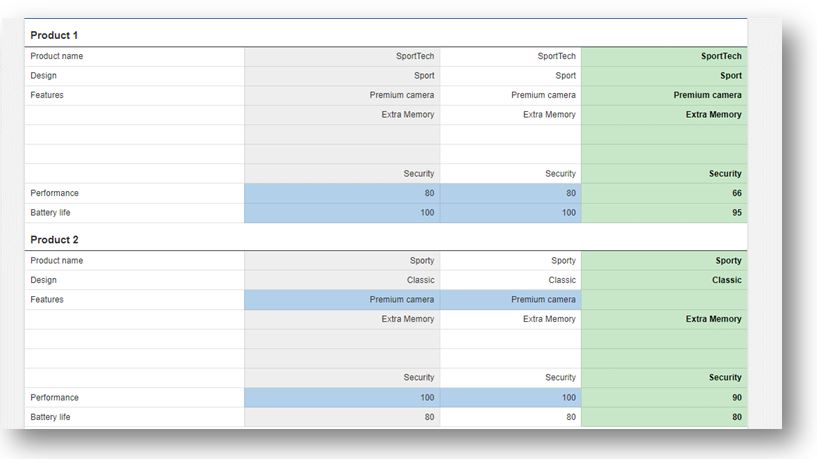

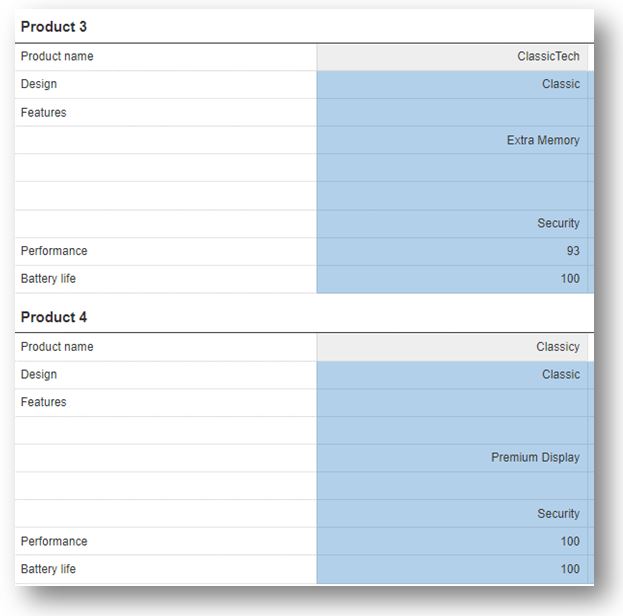

Products Specification

Product 3 and product 4 have the best performance indicators. Sales show the popularity of products 1 and 3, which indicates the affordability of a representative of the sports line. Although Product 2 has additional memory and a premium camera has been dropped, this may have played a role in the lowest segment sales. A premium display in a classic Product 4 design appears to be quite expensive to manufacture but is not as popular with its target consumer group. Therefore, to continue growing in the European and Asian market, it is necessary to make appropriate changes to the product line, leaving the primary development vector the same, as overall sales figures are growing in line with the market. It can be concluded that developing a sports budget line will be promising among the household segment.

Decision

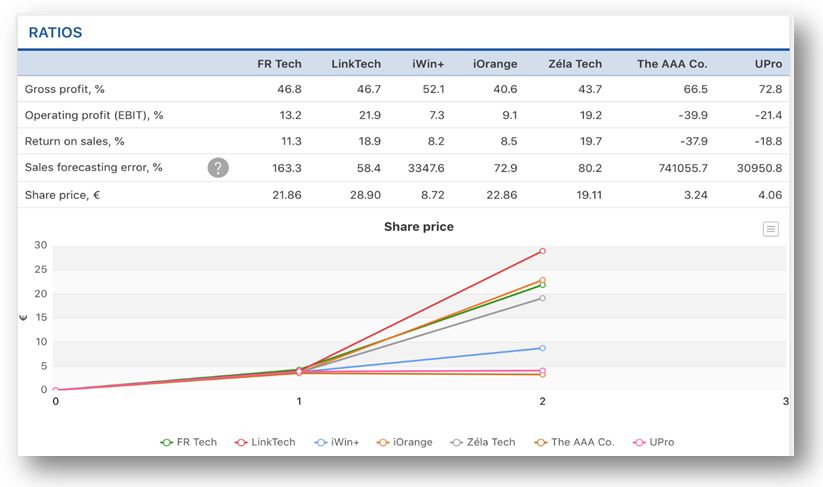

In general, the growth rates and financial indicators, and ratios are more than satisfactory, given the increase in shares by more than three times. Minor changes may be made to the following segments. The current range of diversification of the smartphone product line is best left at the same quantitative level while continuing to improve the quality component. FR Tech has a good market share in the budget smartphone segment, while premium products have low sales figures. It is necessary to conduct market research to study the best-selling products in the Asian market to introduce new products in the most promising region. Realization of the potential in high-end companies in the Asian market will improve the company’s financial performance and create opportunities for the implementation of new high-quality but budget products.

Reference

Huang, C. J., & Jiang, J. C. (2018). Research of smartphone industry outsourcing decision model. Journal of information and optimization sciences, 39(3), 725-737.

Park, C. (2021). Different determinants affecting first mover advantage and late mover advantage in a smartphone market: a comparative analysis of Apple iPhone and Samsung Galaxy. Technology Analysis & Strategic Management, 1-16.

Seo, S. E., Tabei, F., Park, S. J., Askarian, B., Kim, K. H., Moallem, G.,… & Kwon, O. S. (2019). Smartphone with optical, physical, and electrochemical nanobiosensors. Journal of Industrial and Engineering Chemistry, 77, 1-11.