Introduction

Financial statements document a company’s operations and financial status. Governments, accountants, and corporations audit financial accounts to check for mistakes and aid in tax preparation, financing, and investment decisions. Balance sheets, income statements, cash flow statements, and equity change statements are significant for-profit financial statements. San Diego, California, is home to ResMed Inc., a medical equipment manufacturer. The company mainly provides cloud-connected medical devices for treating respiratory disorders such as sleep apnea and chronic obstructive pulmonary disease (COPD). ResMed manufactured hundreds of thousands of ventilators and bilevel devices to treat COVID-19-related respiratory symptoms. ResMed’s software for home health care firms facilitates care transitions for seniors and their caregivers. ResMed’s financial statements can be accessed and compared with those of other companies through the Last10K.com website. The most important things learned in this financial statement analysis is the ResMed’s business strategies and the ability to successfully prepare financial statements and analyze them to achieve the required ratios. The purpose of this paper is to provide the financial statements report for ResMed Inc by focusing on changes in sales, gross profit, and net income, financial ratios, the four financial statements, and the SWOT analysis.

Changes in Sales, Gross profit, Net Income, and Other Financial Analysis of ResMed Inc.

Financial records show firm progress throughout time. These elements include sales volume, gross profit, and income fluctuations. ResMed’s revenue and COGS rose initially. As a result, sales skyrocketed, encouraging more investors to join the bandwagon. An enhancement in customer service that boosts revenue is good for the company. Sales demonstrate how aggressively a corporation seeks client feedback and advice.

ResMed Inc.’s gross profit rose from $17177.86 million in 2020 to $18391.00 million in 2021 and $20243.31 million in 2022. The company’s rising gross profit indicates better asset allocation to boost output and market share. It shows the company’s financial health and prosperity and inspires shareholders with large profits (ResMed, 2022). Gross profit is total sales minus costs. ResMed’s gross profit has grown as falling commodity prices have encouraged higher production and marketing spending. Comparing gross earnings from different periods helps stakeholders evaluate the company’s profitability and output.

ResMed’s net income changes during 2020, 2021, and 2022 due to the economy. The COVID-19 epidemic outlawed several operations in 2020 and 2021, reducing net profits (ResMed, 2022). In 2022, the economy recovered and net income surprise skyrocketed. ResMed’s consolidated statement of stakeholder’s equity shows $6216.76 million, $4745.05 million, and $7794.37 million in three periods. The profitability ratio shows profits per asset by dividing net income by average total assets.

Financial Ratios

A financial ratio is a metric used in business analysis to compare the size of two specific numbers. Startup owners can use financial ratios to gauge their company’s health and compare it to others in the same field. According to Kadim, Sunardi & Husain (2020), financial ratios analyze the correlation between two or more aspects of a company’s financial statements. Effectively employing them requires comparing outcomes over periods. One can then track the company’s progress over time and look for warning flags. The financial ratios of ResMed Inc. include and are not limited to the current debt/equity, inventory turnover, and return on investment ratios.

Current Ratio

The current ratio is a liquidity ratio used to evaluate a firm’s capacity to meet its near-term obligations. A firm’s ability to use its present assets to pay its current liabilities and other payables is discussed, letting investors and analysts know how best to value the company. It is typically accepted to have a current ratio around the market average or somewhat higher. If a company’s current ratio is significantly lower than the average for its sector, this could indicate financial hardship or even default. As with the asset turnover ratio, a high current ratio relative to the industry suggests inefficient management. According to ResMed (2022), the current ratio of ResMed is 2.8021. This reveals that ResMed’s current assets exceed the current liabilities by 2.081 shown in the Appendix 1 in the annex of the paper.

Debt/Equity Ratio

The debt-to-equity (D/E) ratio measures a firm’s indebtedness relative to its equity value. Suppose you want to know how financially leveraged a firm is. In that case, a company should look at its debt-to-equity (D/E) ratio, which is determined by dividing the entire liabilities of the company by the total equity owned by the company’s shareholders. In corporate finance, the D/E ratio is a key indicator. In management, the debt/equity (D/E) indicates how much of the company’s day-to-day operations are being funded by debt instead of the company’s resources. One sort of gearing ratio is the debt-to-equity ratio. The D/E ratio of ResMed is 0.2307, implying that the company is prone to more liabilities than the total amount of stakeholders’ equity as shown in the Appendix 2.3.

Inventory Turnover Ratio

A company’s inventory turnover ratio indicates how often its stock has been depleted and restocked over a given time. The algorithm can also be used to estimate the time needed to sell existing stock. By dividing the cost of products sold by the average inventory over the same time, a company can get the turnover ratio. A higher ratio is preferable to a lower ratio since it indicates healthy sales. Successful inventory control is the foundation for understanding your turnover ratio. ResMed has an inventory turnover ratio of 2.0887, revealing that the company had to replenish its inventory twice over the 2019

Return on Equity (ROE) Ratio

The return on equity ratio (ROE) is a measure of a company’s profitability that accounts for the money shareholders have put into the business. In management, the ROE reveals how much money is made of common stockholders’ equity. The ROE of ResMed is 23.1923, revealing that the stock valuation of the company is good compared to other financial ratios.

Financial Statements of ResMed Inc

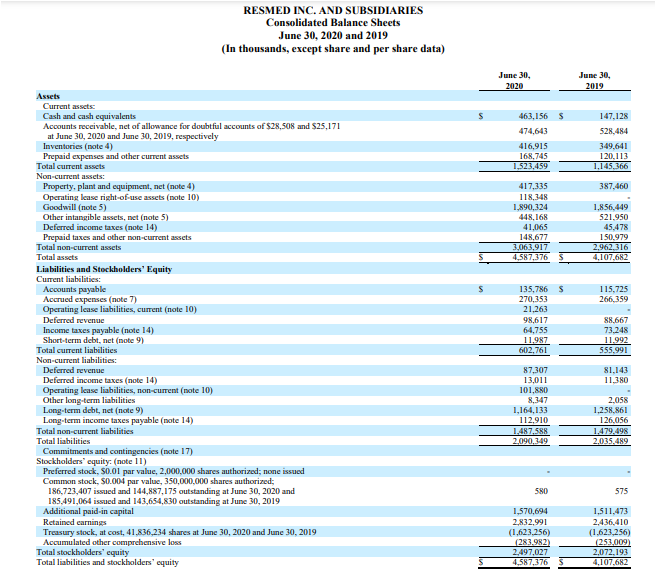

A balance sheet is a statement that summarizes an entity’s financial assets and liabilities as of a specific date. This statement can be prepared for an individual, a business, a partnership, a corporation, a limited liability company, the government, or a nonprofit. The balance sheet is a snapshot in time that shows the relationship between the company’s assets, liabilities, and shareholders’ equity.

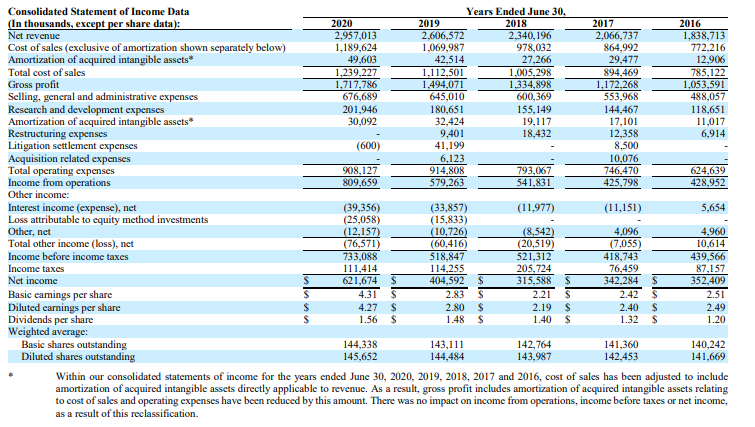

Income Statement

The income statement details the company’s revenue and expenses. It also reveals whether the business is profitable throughout that period. Business financial health can be deduced from the income statement, balance sheet, and cash flow statement. The income statement primarily focuses on a company’s revenues and expenses during a period. Once expenses are subtracted from revenues, the statement produces a company’s profit figure called net income

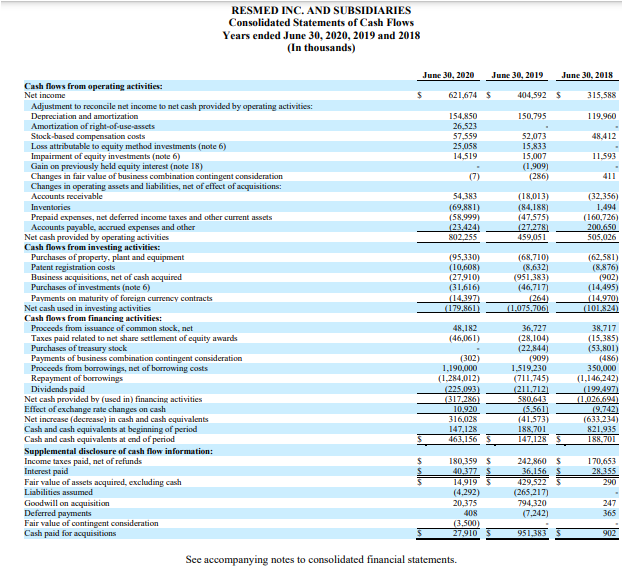

Statement of Cash Flow

The cash flow statement (CFS) measures how well a company generates cash to pay its debt obligations, fund its operating expenses, and fund investments. It complements the balance sheet and income statement. The CFS allows investors to understand how a company’s operations are running, where its money is coming from, and how money is being spent. The CFS also provides insight as to whether a company is on a solid financial. footing

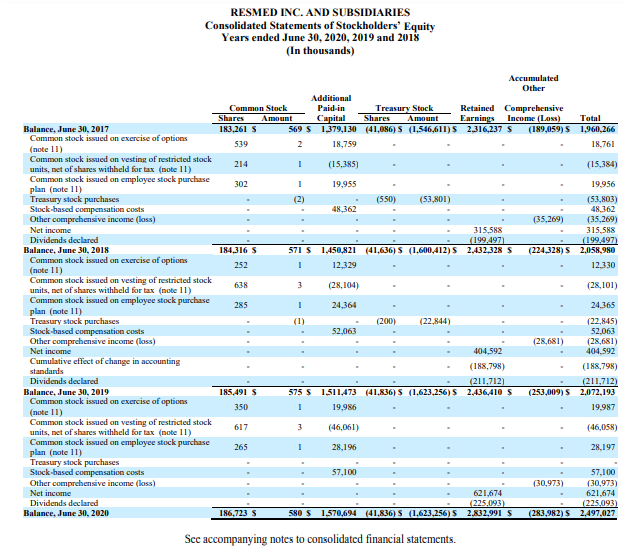

Statement of Changes in Equity

A company’s statement of change in equity details the growth or decline in owner funds over a certain accounting period. The following topics are included: Earnings and expenditures totaled in the form of dividends, and withdrawals from equity. When a company’s earnings are reinvested for expansion or paid to shareholders and other stakeholders, they are documented on the statement of changes in equity.

The SWOT Analysis of ResMed Inc

The SWOT analysis is a strategic tool ResMed company uses to plan its situational analysis. Through SWOT analysis, a company such as ResMed can identify its internal factors, such as strengths and weaknesses, and external factors, such as opportunities and threats.

Strengths

A company’s strengths help it compete for customers. First, ResMed’s dealer network improves business performance. A strong dealership boosts sale by educating and attracting customers, which boosts performance (Kadim, Sunardi & Husain, 2020). Second, the company’s skilled staff deliver excellent customer service. ResMed is a strong community dealer because of its distributors and dealers’ culture. ResMed dealers promote the company’s products and train sales staff. According to ResMed (2022), the company’s high returns on capital expenditures help it develop new projects. ResMed’s training and learning programs have produced highly trained employees. ResMed invests much in employee training and development.

Weaknesses

The company faces challenges as it propagates its operations, limiting its efficiency. ResMed experiences a long period of inventory compared to its competitors. The lack of a comprehensive inventory period creates difficulty in comparison to the performance of the companies, thus failing to understand the market (Kadim, Sunardi & Husain, 2020). ResMed must reinstate a system that helps its management quickly evaluate its performance compared to the entire medical industry.

Opportunities

Opportunities are areas where a corporation sees growth, market share, and profits. ResMed Inc has a growing lower-segment consumer base. ResMed clients shifted from disorganized to licensed healthcare businesses (ResMed, 2022). This enables ResMed to enter no-frills entry-level markets. ResMed’s fast-changing client preferences provide for easy information access and speedy product uptake. ResMed customers are willing to try new items. ResMed detects changes in healthcare supplies and equipment. ResMed’s local collaboration opportunities help local participants flourish in global markets. ResMed brings international processes and implementation experience to these local participants.

Threats

Changes in consumer attitudes and macroeconomic circumstances can threaten a company’s business models. ResMed is vulnerable to China-US trade conflicts, technology disruption, environmental risks, and new competition. First, the China-US trade war affects ResMed’s medical supplies and equipment opportunities. China’s medical supply and equipment are inferior (ResMed, 2022). The confrontation between China and the US affects Chinese economic models. Second, hacking and piracy threaten ResMed’s technology. Modern corporations are vulnerable to hackers and technology disruptors (Toleuuly et al., 2019). This threatens ResMed’s future. Climate change disruptions cause environmental problems. ResMed’s access to EU money for environmental concerns threatens new competitors. The 2008-2009 recession reduced US business formation, resulting in a new competition. ResMed faced severe competition in the medical equipment and supplies sector after 2020 business applications in the US.

Conclusion

Managers can utilize financial statements as a means of keeping tabs on performance, budgets, and other data, as well as for making choices, inspiring their staff, and keeping an eye on the big picture. Financial statements include the income statement, balance sheet, and cash flow statement. Traders can use these three statements as a fast snapshot of a company’s financial health and value. Most readers will place the most weight on the income statement because it provides insight into a company’s profitability. However, the balance sheet, income statement, cash flow statement, and statement of changes in equity provide an analysis of ResMed Inc.’s current and past performance.

References

Kadim, A., Sunardi, N., & Husain, T. (2020). The modeling firm’s value based on financial ratios, intellectual capital, and dividend policy. Accounting, 6(5), 859-870. Web.

Toleuuly, A., Yessengeldin, B., Jumabaeva, S., & Zhanseitov, A. (2019). Contemporary problems and prospects of e-commerce development in modern conditions. Revista Espacios, 40(06). Web.

ResMed Inc. (August 22, 2022). ResMed Inc (RMD) SEC Filing 10-K Annual Report for the fiscal year ending Thursday, June 30, 2022. 10-K Annual Report ResMed Inc (RMD) 10K Annual Reports & 10Q SEC Filings (last10k.com)

Appendices

Appendix 1: Financial Ratios

Appendix 2: Financial Statements

Income Statement

Balance Sheet

Statement of Stockholder’s Equity

Statement of Cash Flow