Introduction

The petrochemical industry is the most significant contributor to the economy of Saudi Arabia, where the most prominent player on its market became Saudi Arabian Basic Industries Corporation (SABIC). SABIC is listed as the world’s fourth-largest firm in the chemical industry (Seznec, 2020). For example, SABIC had sales of more than $32 million in 2020, with $17 million being the net profit (SABIC, 2020). SABIC owns operating offices in 50 countries, employing more than thirty thousand people worldwide (SABIC, 2020). Although this company was merged with Saudi Aramco oil and gas corporation in 2019, SABIC did not change its primary focus on petrochemicals, fertilizers, metals, and specialty plastics (Seznec, 2020). The five forces model allows to determine the nature of the competition in the petrochemical industry and discover external changes that may affect SABIC.

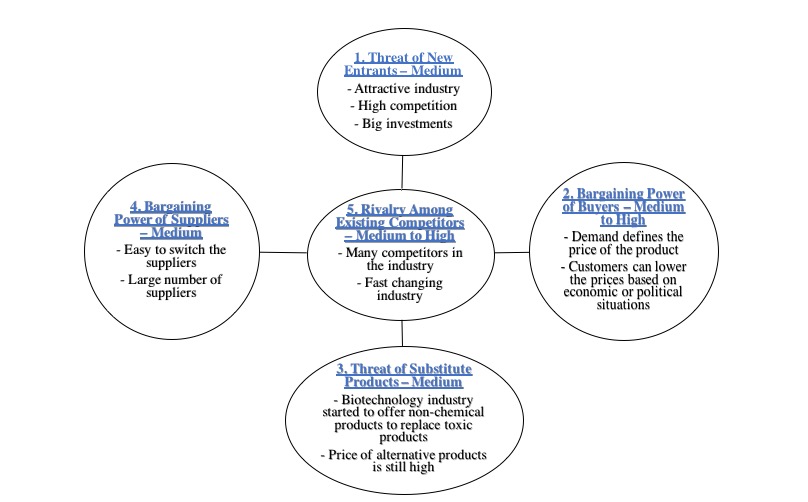

Five Forces Model for SABIC

The five forces model can be used to identify the existing threats and opportunities for a company. Michael Porter developed this model in the 1970s to help companies achieve competitiveness in the industry by leveraging special external forces (Goyal, 2020). The five forces model can be used to analyze SABIC’s competitiveness in the market (Figure 1). It appears that SABIC needs to manage all five forces to maintain its competitive advantage in this industry.

The threat of New Entrants

According to the five forces model, the threat of new entrants in this industry was medium. The potential entrants into the industry, such as new oil and gas corporations, may be threatening the established companies’ stability (Goyal, 2020). The petrochemical industry in Saudi Arabia has medium entry barriers because the government is interested in building a robust crude oil and gas infrastructure in the region (Akhtar & Asif, 2017). Thus, significant investments may bring new entrants into this business, creating competition in addition to the existing rivalry in this field.

Bargaining Power of Buyers

The bargaining power of buyers was determined to be medium to high in this industry. If customers have high bargaining power in the industry, they can substantially lower the prices, reducing the company’s profit (Adelakun, 2020). In the petrochemical industry, the profit mainly depends on the demand. SABIC is the fourth largest chemical corporation in the world. However, the global crisis caused by the coronavirus pandemic affected this firm’s profit. For example, SABIC’s net income dropped by 10% in 2020 compared to 2019 due to the challenges imposed by the ongoing COVID-19 pandemic (SABIC, 2020). This decrease in the income can be attributed to the high bargaining power of buyers to reduce costs during the coronavirus crisis.

Threat of Substitute

The threat of substitutes in this industry was found to be medium. There are biological substitutes that can diminish the value of traditional chemical products in the future because the customers’ preferences are shifting to environmentally friendly products (SABIC, 2020). If customers decide to switch to cheaper and environmentally-friendly biologic products and alternative energy sources, the petrochemical industry may experience a substantial loss of income. However, the development of these products is still at the initial stages of development, and prices for these non-chemical products are still high, which may significantly delay the substitution.

Bargaining Power of Suppliers

According to Porter’s model, the bargaining power of suppliers was defined to be medium. Suppliers may threaten the industry by establishing higher prices for materials, and higher crude material costs may worsen the quality of products (Goyal, 2020). However, in the petrochemical industry, it is relatively easy to switch suppliers. Therefore, suppliers cannot significantly affect the company’s profit because there are many of them on the market.

Rivalry Among Existing Competitors

Rivalry among the existing competitors in this field was found to be medium to high. The competitive forces can have a significant impact on the profitability of the company. The competitive nature of the petrochemical industry requires companies to monitor rivals’ strategies and introduce a technical improvement to remain on a competitive edge (SABIC, 2020). SABIC remains the leader of the chemical industry in the region due to its effective rationalization strategies (Akhtar & Asif, 2017). However, this industry is a rapidly changing field; thus, the firm will need to adapt quickly to maintain its competitiveness in the future.

Nature of Competition in the Industry

The nature of the rivalry within the industry can determine profit for the competitors. Because the five forces influence all competitors equally in this industry, the petrochemical industry can be considered profitable because benign rivalry allows for maintaining positive net income. SABIC’s rational resource utilization enables the company to be recognized as the country’s most efficient firm (Akhtar & Asif, 2017). Nevertheless, SABIC needs to continue to monitor the market for new entrants and substitutes to re-organize its work if necessary. Therefore, petrochemical corporations should not underestimate the power of their future competitors.

Changes in the External Environment

SABIC is a significant player in the global chemical industry, making it vulnerable to changes in the world economy. Oil and gas prices are unstable on the worldwide market; thus, a price reduction may affect this corporation’s profit (SABIC, 2020). Moreover, the current rules require SABIC to use proper disposal methods of toxic chemicals that they utilize and produce, but the corporation admits that using these methods is costly (SABIC, 2020). Furthermore, any accidental disposal of dangerous chemicals can lead to severe legal and financial responsibilities for this company (SABIC, 2020). The pandemic resulted in the decreased demand for the petrochemical industry products due to the travel restrictions worldwide that damaged the global economy.

Effect of the Pandemic on Petrochemical Industry

The crisis in the global economy caused by the ongoing pandemic had a negative impact on the petrochemical industry. At the beginning of the lockdown, SABIC incurred considerable losses because of the decline in demand for many of this firm’s products (SABIC, 2020). Although SABIC received a large governmental order for ethanol production for sanitation purposes, fluctuation in oil and gas prices affected the company’s income in the past year (SABIC, 2020). Indeed, many petrochemical corporations were affected by the pandemic and the resulting economic disturbance because it directly affected buyers, forcing price reduction. Nevertheless, SABIC managed to maintain positive net income in 2020 and introduce innovative approaches to remain competitive and deliver high-quality chemical products.

Conclusion

Overall, Saudi Arabian Basic Industries Corporation remains one of the leading players in the petrochemical industry worldwide. Despite the influence of the five forces that create a competitive environment, this firm continues to preserve its high production efficiency. Although rivalry is an integral part of this industry, balanced competition allows firms to be profitable. However, the coronavirus pandemic affected the product demand and customers’ buying capacity, resulting in financial losses in this industry.

Recommendations

Recovery of this industry after the pandemic may require three strategies based on the five forces model. First, to overcome the threats of substitute products, the company needs to introduce sustainable innovations. Second, to control the bargaining power of the buyer, the firm can switch customers. Finally, the corporation needs to focus on cost reduction to overcome the threat of new entrants in the future.

References

Adelakun, A. (2020). Should Porters five forces have value in businesses today. Web.

Akhtar, M. H., & Asif, M. (2017). Evaluating managerial efficiency of petrochemical firms in Saudi Arabia. Benchmarking: An International Journal, 24(1), 244-256. Web.

Goyal, A. (2020). A critical analysis of Porter’s 5 forces model of competitive advantage. International Journal of Emerging Technologies and Innovative Research, 7(7), 149-152.

SABIC. Sustainability report 2020. Web.

Seznec, J. F. (2020). The Saudi Aramco-SABIC merger: How acquiring SABIC fits into Aramco’s long-term diversification strategy. Atlantic Council. Web.