Introduction

At present, the Chinese market is one of the most attractive investments for entrepreneurs globally due to its large population and increasing consumerism. Nevertheless, it is essential to conduct thorough research of the existing challenges, competitors, demographic groups, and other critical factors before entering the market. The current paper investigates the opportunities for a company that sells health supplements and vitamins online. Ultimately, the analysis thoroughly examines the existing structure of the Chinese health supplement market to establish the groundwork for a company start-up.

Health Supplements Market Overview

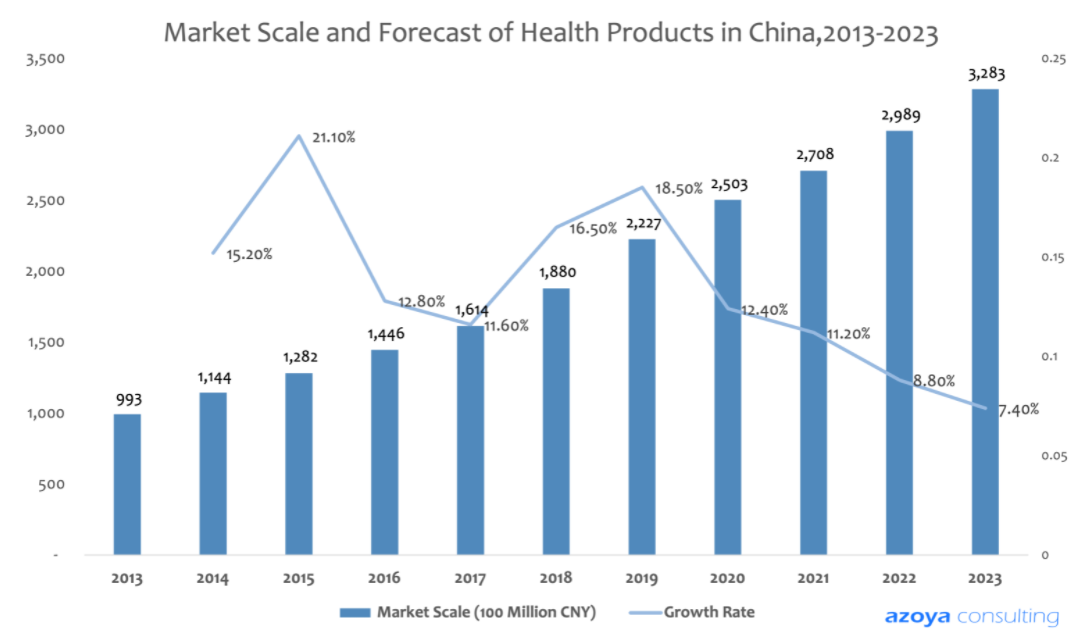

First, it is essential to provide a comprehensive overview of the health supplements market and trends in the industry. The recent COVID-19 outbreak has significantly raised public awareness concerning health issues, leading to the growing popularity of health supplements and vitamins (“Skin and Immunity Concerns” par. 1). The general trend of healthcare products has been steadily increasing over the last decade, which transparently demonstrates the importance of health issues among Chinese citizens (see fig. 1).

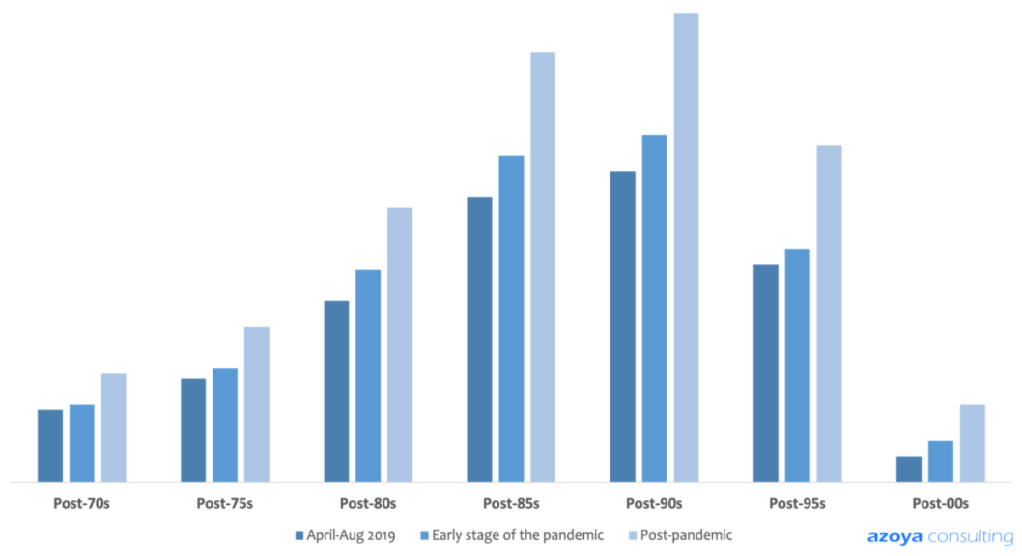

While the growth rate has been gradually declining, the market provides multiple opportunities for new companies that aim to sell health supplements and vitamins. Furthermore, the research demonstrates that many Chinese citizens shift their preferences from conventional treatment to imported healthcare goods, creating opportunities for foreign investors (Yao and Huang par. 4). COVID-19 outbreak has significantly increased the public awareness concerning the necessity of health supplements to strengthen immunity and improve the quality of life. Figure 2 below represents the overall changes in the consumer behavior among various age groups in the Chinese market:

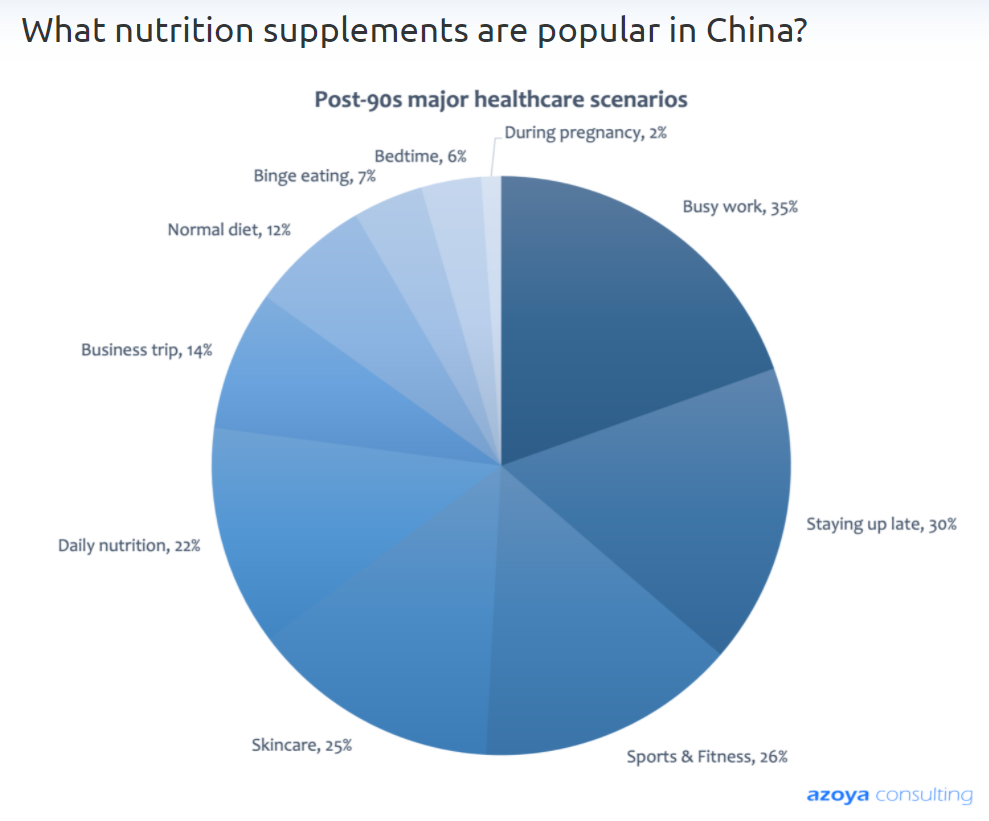

Moreover, it is essential to analyze what health supplements and vitamins are becoming major elements in the Chinese market. The most popular reason for buying health supplements is their contribution to general health and energy levels, which would allow people to endure busy work schedules or stay up late (Yao and Huang par. 8). These activities have an immense physical toll, leading to loss of energy, health issues, and mood swings, and health supplements might effectively mitigate these concerns. Moreover, skincare and sports supplements segments have been gradually increasing in popularity, making them a solid choice for investment. The general distribution of nutrition supplements popularity is presented below in figure 3.

Lastly, the health supplements market in China has several advantages compared to the Western markets. Namely, China is a growing economy, and customers’ purchasing power is steadily increasing, which would allow them to buy optional healthcare products (“How to Market Vitamins” par. 8). Consequently, China suffers from an aging population, and many older adults might need to support their health via vitamins. Following economic growth, China undergoes a rapid process of digitalization, making online sales platform an attractive investment in the market (“How to Market Vitamins” par. 8). In summary, the current plan to start a company that sells health supplements and vitamins online might be a highly profitable initiative.

Demographic Groups

Consequently, it is essential to analyze which demographic groups might be interested in imported health supplements and vitamins. Depending on the chosen health supplement product, there are two attractive demographic groups – younger adults who enjoy imported Western goods and older adults who require health support via vitamins. As mentioned briefly before, Chinese economic growth allows younger consumers in the 20-45 age group to buy optional healthcare products, such as health supplements for sports performance or skincare (Yao and Huang par. 9). On the other hand, the aging population provides opportunities for product lines of essential vitamins. Despite the approach, the company should tailor its marketing campaign with a specific focus on the demographic groups.

Marketing Research and Advertisement

Marketing is essential to every business, and selling products in a foreign market is a particularly challenging task. First of all, the company must localize the products and tailor its marketing campaign according to the needs of the Chinese market (“How to Market Vitamins” par. 26). English might be used for catchy slogans, but most information should be in Chinese. Consequently, the Western and Chinese understanding of advertisement design differs significantly, and the company needs to ensure the highest quality of the brand image. It concerns the advertisements, product packages, and potential customization (Yao and Huang par. 16). From these considerations, the company should tailor its marketing campaign to the realities of the Chinese market.

At present, there is an extensive number of popular social networks and applications that could be used to promote products. Some of the most prominent ones include WeChat, Weibo, Xiaohongushu, and Douyin (“Vitamins and Dietary Supplements” par. 15). Consequently, the company needs to create a website that must be hosted in China due to legislative reasons (“How to Market Vitamins” par. 24). Ultimately, a positive brand image is essential to business, and social media networks might effectively promote the products.

Competitors

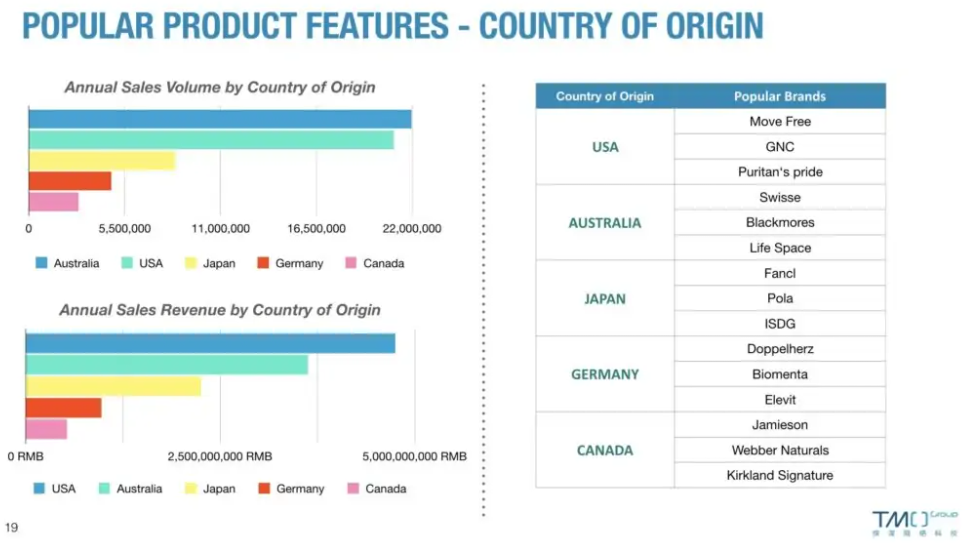

Since the Chinese market is a highly prosperous platform for health supplements sales, there is an extensive number of competitors. The research by TMO Group provides the following infographic (see fig. 4) concerning the foreign brands in the market (“Overseas Health Supplement” par. 13).

Nevertheless, the research shows that e-commerce via TMall is an attractive alternative for smaller brands. TMall Global Import Supermarket and Ali Health Overseas Store provide opportunities for various companies to advertise and sell their products (“Overseas Health Supplement” par. 17). This approach allows mitigating the competition from well-established brands that primarily operate through flagship store sales. Ultimately, there is a large number of competitors in the Chinese market for health supplements, but it is possible to minimize this issue via intelligent marketing and approach to sales.

Challenges and Solutions

The primary challenge of the current initiative is the high density of competitors and the reluctance of the Chinese citizens to buy from new brands. According to the recent research by the Chinese Nutrition Society, most customers prefer to buy from trusted and well-established international brands (Yao and Huang par. 32). The potential response to the problem is to differentiate the product via intelligent segmentation and marketing strategies. The prevalence of e-commerce in the market might allow the company to steadily increase its scope of influence and attract a loyal customer base. In this case, it is possible to slightly mitigate the challenge posed by the density of competitors and customers’ preferences.

Conclusion

The current paper has thoroughly examined the market and revealed that selling health supplements and vitamins in e-commerce might become a highly successful initiative in China. The Chinese market has a large number of advantages compared to Western markets, such as shifting consumers’ preferences, rapid digitalization, and a growing economy. Ultimately, if the company can create an effective marketing campaign and differentiate its products, it will succeed in the Chinese health supplements market.

Works Cited

“How to Market Vitamins & Health Supplements in China.” Marketing to China, 2021, Web.

“Overseas Health Supplement Market in China in 2021: TMall Sales Analysis.” TMO Group, 2022, Web.

“Skin and Immunity Concerns Drive the Vitamin Market in China.” DauxeConsulting, 2020, Web.

“Vitamins and Dietary Supplements Market in China 2020 Update.” Seo Agency China, 2020, Web.

Yao, Queenie and Davy Huang. “Key Trends of Health Supplement Markets in China 2022.” Azoya, 2021, Web.